The subscription for the Vikram Solar IPO is closed, and the wait for the results is on!

The allotment status is expected to be finalized late tonight (Friday, August 22nd).

Become a Stock Market PRO!

Join @Mobodaily Telegram Channel Get high-quality swing trading ideas (averaging 10%+ returns), daily market news & crucial IPO reviews.

This guide provides the direct link to the Link Intime (now MUFG Intime) website and the exact steps to check your allotment status.

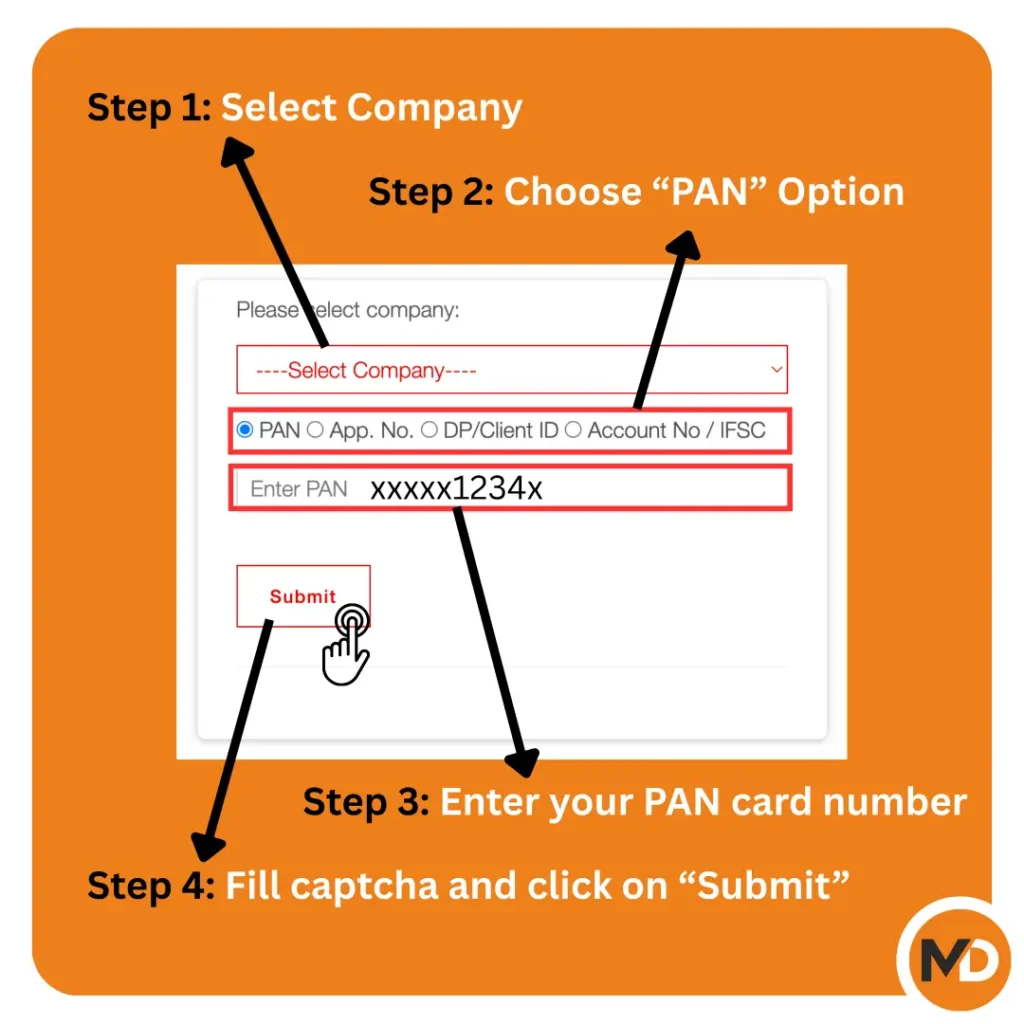

How to Check Your Vikram Solar IPO Allotment Status

The official registrar for the Vikram Solar IPO is MUFG Intime India Pvt Ltd. The results will be updated on their official website later this evening.

Direct Link to Check Allotment: Click Here for MUFG Intime Allotment Status

Do you NEVER get the allotment?

I suggest you applying through through Angle One. Here’s why:

✅ Quick & Easy Application: Apply in just a few clicks with pre-filled details.

✅ UPI-Based Payments: Simple and fast payment process for bids up to ₹5 lakh.

✅ Zero Application Charges: No fees are charged for applying for an IPO.

✅ Pre-Apply Option: Place your bid before the IPO opens to avoid the last-minute rush.

✅ Easy Tracking: Monitor your application status from bidding to allotment on one platform.

✅ Informed Decisions: Access details and research on all upcoming IPOs.

Special Offer: Open a FREE account, and get ₹500 worth of brokerage credit to your account! (Limited period offer)

How to Check IPO Allotment Status Using Your PAN Card):

- Click on the direct link provided above.

- On the allotment page, find the dropdown menu under “Select Company” and choose “Vikram Solar Limited”. (Note: This option will only appear after the status is officially declared live by the registrar, likely late this evening).

- By default, the “PAN” option will be selected. Enter your 10-digit Permanent Account Number (PAN) accurately.

- Enter the Captcha for verification.

- Click the “Submit” button.

Your allotment status will then be displayed on the screen, showing how many shares you have been allotted.

Frequently Asked Questions (FAQ)

A: The process to unblock your UPI mandate fund (your refund) will begin on Monday, August 25th. You should see the amount reflected in your bank account by that evening or the next business day.

Q: The company name “Vikram Solar” is not in the list. What do I do?

A: This is normal. It just means the allotment results are not yet live. The data is usually uploaded late in the evening (typically after 7 PM) on the allotment date. Keep checking the link periodically.

Q: It says “No records found” after I submit my details. What does that mean?

A: Unfortunately, this means you were not allotted any shares in the IPO lottery. Due to high subscription, not all applicants receive shares.

Q: I wasn’t allotted any shares. When will I get my refund?

Related: How to Check Patel Retail IPO Allotment Status? [Direct Link]

Vikram Solar IPO Details: A Quick Summary

| Detail | Information |

|---|---|

| IPO Dates | August 19, 2025 – August 21, 2025 |

| Price Band | ₹315 – ₹332 per share |

| Face Value | ₹10 per share |

| Issue Size | ~₹2,079.37 crore total — Fresh Issue: ~₹1,500 crore — Offer for Sale (OFS): ~₹579.37 crore |

| Minimum Lot Size | 45 shares (₹14,940 at upper band) |

| Retail Portion | 35% (~₹728 crore) |

| Registrar | MUFG Intime India Pvt. Ltd. |

| Listing Exchanges | BSE & NSE |

Key Takeaways

- Market Cap: At the upper price band of ₹332, Vikram Solar seeks a market capitalization of ~₹7,800–8,000 crore.

- Purpose of Issue: The fresh issue (~₹1,500 crore) is aimed at capacity expansion and working capital, supporting the company’s growth plans.

Vikram Solar IPO Key Dates

| Event | Date |

|---|---|

| IPO Opening Date | Tuesday, August 19, 2025 (open) |

| IPO Closing Date | Thursday, August 21, 2025 |

| Basis of Allotment Finalization | Friday, August 22, 2025 |

| Refund Initiation | Monday, August 25, 2025 |

| Shares Credit to Demat Accounts | Monday, August 25, 2025 |

| Tentative Listing Date | Tuesday, August 26, 2025 |

Update: Regaal Resources IPO allotment status is live

Vikram Solar Issue Size & Offer Details

Here’s a breakdown of how much money Vikram Solar is raising and, importantly, where that money is going. This is a critical factor in understanding the purpose of the IPO.

- Total Issue Size: The company aims to raise approximately ₹2,079 crore from this public offering.

- Fresh Issue: ₹1,500 crore of the total amount is a “Fresh Issue.” This means the money goes directly to the company to fund its growth, expansion, and other corporate purposes.

- Offer for Sale (OFS): The remaining ₹579 crore is an “Offer for Sale.” This money goes to the existing shareholders who are selling a portion of their stake.

- Retail Portion: A significant portion of IPO, 35% (~₹728 crore) is reserved for retail investors.

- Price Band: The IPO price has been set in the range of ₹315 to ₹332 per share.

- Registrar: The official registrar for the IPO, responsible for the allotment and refund process, is MUFG Intime India Private Limited.

✅ Expert Insight: It’s a strong positive signal for retail investors that a large portion (~₹1,500 crore) of this IPO is a Fresh Issue. It shows that the primary goal is to raise capital for the company’s future growth, not just to provide an exit for current owners.

Vikram Solar IPO: Lot Size & Investment Amount

Here’s exactly how much you will need to invest to apply for the Vikram Solar IPO. In a mainboard IPO, you apply for shares in “lots,” and the company sets a minimum lot size.

- Lot Size: For the Vikram Solar IPO, the minimum you can apply for is 1 lot, which contains 45 shares. You can then apply in multiples of 45 (e.g., 90 shares, 135 shares, and so on).

- Minimum Retail Investment: At the upper price band of ₹332 per share, the minimum investment required to apply for one lot is ₹14,940 (45 shares x ₹332).

- Maximum Retail Investment: As a retail investor, the maximum you can apply for is 13 lots (which is 585 shares), for a total investment of ₹194,220.

✅ Expert Insight: Why the ₹2 lakh limit? SEBI defines a “Retail Individual Investor” as anyone who applies for shares worth up to ₹2,00,000. Applying for 13 lots keeps you just under this threshold, ensuring you are included in the retail category, which has a specific portion of the IPO reserved for it (in this case, 35%).

Vikram Solar Promoters

The promoters behind Vikram Solar Limited are:

- Gyanesh Chaudhary

- Gyanesh Chaudhary Family Trust

- Vikram Capital Management Private Limited (formerly Monolink Trexim Pvt. Ltd.)

These entities collectively hold approximately 77.64% ownership before the IPO, which is expected to reduce to around 63.11% post-IPO.

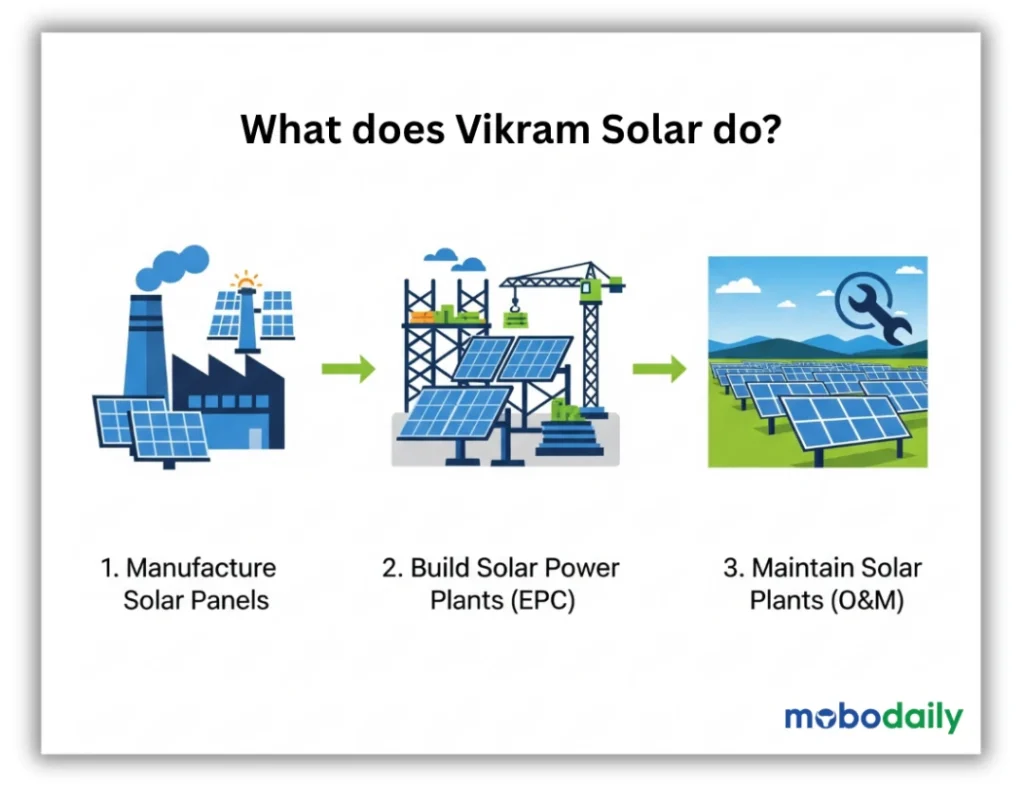

What is Vikram Solar & How Does it Make Money?

Vikram Solar is one of India’s largest manufacturers of solar panels, also known as solar modules. Unlike companies that focus only on selling panels or generating electricity, Vikram Solar handles everything from manufacturing to installation.

How the Business Works

Vikram Solar’s business is “vertically integrated,” which means they are involved in the entire process of creating solar power solutions. Think of it like this:

- They Manufacture: They take the raw materials, like silicon wafers, and manufacture them into high-efficiency solar panels at their large factories.

- They Build: They have an EPC (Engineering, Procurement, and Construction) division. This is a fancy term for a team that designs, builds, and sets up entire solar power plants for other companies, using their own panels.

- They Maintain: After a solar plant is built, they also offer operations and maintenance (O&M) services to ensure it runs efficiently.

Scale & Capacity

- Manufacturing Capacity: ~4.5 GW of solar modules annually, making it one of India’s top solar manufacturers.

- Integration Advantage: Being vertically integrated gives Vikram Solar better control over quality, cost, and timelines compared to competitors.

The Key Takeaway: Vikram Solar makes money primarily by manufacturing and selling solar panels, and by providing services to build and maintain large-scale solar projects. Their scale is massive, with a manufacturing capacity of ~4.5 Gigawatts (GW), making them one of the true heavyweights in India’s solar industry.

Vikram Solar Financials: Is the Company Profitable?

Here’s a breakdown of key Vikram Solar financial metrics for FY23 to FY25:

Financial Snapshot (₹ Crores)

| Metric | FY23 | FY24 | FY25 |

|---|---|---|---|

| Revenue | ₹2,073 | ₹2,511 | ₹3,423 |

| EBITDA | ₹186 | ₹398 | ₹492 |

| EBITDA Margin | 8.98% | 15.87% | 14.37% |

| Net Profit (PAT) | ₹14.49 | ₹79.72 | ₹139.83 |

| PAT Margin | 0.70% | 3.17% | 4.08% |

| Earnings Per Share (EPS) | ₹4.42 | — | — |

Key Takeaways

- Revenue Growth: Vikram Solar has demonstrated strong revenue growth, increasing from ₹2,073 crore in FY23 to ₹3,423 crore in FY25, reflecting a 65% growth over the period.

- Profitability Improvement: The company has significantly improved its profitability, with net profit rising from ₹14.49 crore in FY23 to ₹139.83 crore in FY25. This indicates a robust growth trajectory.

- Margin Trends: While the EBITDA margin slightly decreased from 15.87% in FY24 to 14.37% in FY25, it remains healthy and indicates operational efficiency.

- Earnings Per Share (EPS): The EPS for FY23 stands at ₹4.42. However, for FY24 and FY25, EPS figures are not disclosed in the available data.

Valuation Insights

- Price-to-Earnings (P/E) Ratio: Based on the diluted EPS for FY25, the P/E ratio at the upper end of the price band (₹332) is approximately 72.17 times, which is higher than the average industry peer group P/E ratio of 44.28 times for FY25 .

- Return on Net Worth (RoNW): The RoNW stands at 11.26%, indicating a decent return on shareholders’ equity .

Vikram Solar vs Adani Green vs Tata Power Solar

Understanding how Vikram Solar stacks up against its major competitors—Adani Green and Tata Power Solar—is crucial for investors seeking to differentiate between business models, growth prospects, and valuation metrics.

Business Model Comparison

| Aspect | Vikram Solar | Adani Green Energy | Tata Power Solar |

|---|---|---|---|

| Primary Focus | Solar module manufacturing, EPC services, and O&M | Renewable energy generation (solar & wind), transmission, and distribution | Integrated energy solutions: generation, EPC services, and solar manufacturing |

| Revenue Streams | Sale of solar modules, EPC contracts, and O&M services | Sale of electricity from renewable sources, power trading | Sale of electricity, EPC contracts, and solar product sales |

| Market Position | Leading domestic solar module manufacturer with a growing presence in the U.S. | Largest renewable energy company in India with a diversified portfolio | Established player in the Indian energy sector with a strong brand presence |

| Ownership | Privately held | Publicly traded (NSE: ADANIGREEN) | Publicly traded (NSE: TATAPOWER) |

Analysis:

- Vikram Solar is a direct play on manufacturing efficiency and module sales, unlike Adani Green, which is primarily generation-focused.

- Retail investors seeking exposure to India’s solar manufacturing growth may favor Vikram, while Adani Green appeals to those betting on large-scale renewable power generation.

- Tata Power Solar combines both approaches, offering stability and brand trust, but with less manufacturing focus than Vikram.

Financial Comparison (FY25)

| Metric | Vikram Solar | Adani Green Energy | Tata Power Solar |

|---|---|---|---|

| Revenue | ₹3,423.5 Cr | ₹11,212 Cr | ₹5,337 Cr |

| Net Profit (PAT) | ₹139.8 Cr | ₹1,444 Cr | ₹422 Cr |

| PAT Margin | 4.08% | 12.87% | 7.91% |

| P/E Ratio (Sector P/E = 44.28x) | 72.17x | 88.3x | 30.2x (Tata Power) |

Analysis:

- Vikram Solar’s high P/E ratio (72x) signals that investors are paying premium for future growth, not current profits.

- Adani Green shows strong scale with robust profits, but its high P/E reflects market optimism on renewable power expansion.

Capacity & Expansion Plans

| Company | Installed Capacity (GW) | Expansion Target (GW) | Target Year |

|---|---|---|---|

| Vikram Solar | 4.5 | 20.5 | FY27 |

| Adani Green Energy | 20.0 | 25.0 | FY28 |

| Tata Power Solar | 5.0 | 15.0 | FY26 |

✅ Expert Insight:

- Vikram Solar is aggressively scaling up manufacturing capacity, aiming for over 4× growth in 2 years, which could drive revenues if solar demand remains strong.

- Adani Green maintains the largest generation capacity, positioning it as a dominant renewable power player in India.

- Tata Power Solar is expanding moderately but benefits from brand credibility and EPC expertise, ensuring stable project execution.

Vikram Solar IPO: Strengths vs. Risks (Good or Bad?)

| ✅ Key Strengths | ⚠️ Key Risks |

|---|---|

| Market Leader: One of India’s top solar module manufacturers with a growing international presence. | Competition from China: Faces stiff competition from cheaper Chinese solar panels. |

| Government Push: Beneficiary of India’s renewable energy policies and incentives. | Policy Dependence: Changes in subsidies, tariffs, or import duties can impact profits. |

| Vertically Integrated: Controls the entire value chain from modules to EPC projects. | Raw Material Volatility: Prices of silicon and other inputs can fluctuate. |

| Expansion Plans: Capacity ramp-up to 20.5 GW by FY27. | High Valuation: Premium P/E ratio priced for future growth. |

Vikram Solar IPO: The Final Verdict

After analyzing the business model, financials, capacity, competitors, and risks, here’s the straightforward conclusion:

Verdict

✅ Vikram Solar IPO is suitable for long-term investors.

- Why: It is a market leader in solar module manufacturing, fully integrated, and positioned to benefit from India’s renewable energy push.

- Growth potential: Capacity expansion to 20.5 GW by FY27 supports strong revenue upside.

- Valuation: The premium P/E (~72x) reflects growth expectations; short-term listing gains are uncertain.

Actionable Advice

- Long-term growth: ✅ Subscribe if you can hold for 3–5 years.

- Short-term caution: ⚠️ Apply with caution expecting small listing profits.

How to Apply for the Vikram Solar IPO: Step-by-Step Guide

Applying for the Vikram Solar IPO is simple and beginner-friendly. Here’s a clear roadmap:

1️⃣ Step 1: Get Your Details Ready

To apply for any IPO, you first need a Demat & Trading Account.

- If you already have an account, you’re all set to move to the next step.

- If you need to open an account, you can open one for free with a trusted broker like AngelOne.

➡️ Open Your Free AngelOne Demat Account Here

2️⃣ Step 2: Log in to Your Demat Account

You can apply through your broker’s trading app or website (Angel One, Zerodha, ICICI Direct, etc.)

3️⃣ Step 3: Select the IPO

- Navigate to the IPO section of the platform.

- Find Vikram Solar IPO and click Apply.

4️⃣ Step 4: Enter Application Details

- Number of shares: Enter the lot size (minimum 45 shares).

- Price band: Select the cut-off price i.e. ₹332.

- UPI ID: Enter UPI ID linked with your bank account (Google Pay, PhonePe, Paytm, etc.)

5️⃣ Step 5: Authorize Payment via UPI

- You will receive a UPI payment request on your linked UPI app.

- Approve the request – no money leaves your account until allotment.

6️⃣ Step 6: Submit Application

- Review details and click Submit.

- Note the application number for tracking the allotment status.

✅ Pro Tips for Retail Investors

- Apply at cut-off price: Maximizes chances of allotment.

- Limit lots: Stick to 1–3 lots if you’re risk-averse.

- Double-check details: Ensure your PAN, Demat, and bank account are correct.

- Use ASBA: It’s safer than paying upfront via cheque or NEFT.

Final Takeaway

The Vikram Solar IPO is one of the most anticipated issues in India’s renewable energy space. With strong fundamentals, robust order book, and expansion plans, it has attracted huge investor interest.

For retail investors, the easiest way to participate is by applying through a Demat account with UPI authorization – a quick, paperless, and hassle-free process.

Don’t miss the chance to be part of India’s clean energy growth story.

(Disclaimer: This article is for educational purposes only and should not be considered investment advice. Stock market investments are subject to risks. Please consult your financial advisor and read the IPO prospectus carefully before applying.)

- 10+ Best SEBI-Registered Telegram Channels 2026 - February 25, 2026

- Top 5 SEBI-Registered Telegram Channels For Option Trading [2026] - February 12, 2026

- 10 Best Nifty 50 Options Trading Telegram Channels [2026] - February 12, 2026

Discover more from Mobodaily

Subscribe to get the latest posts sent to your email.