The ₹2000 Cr Travel Food Services (TFS) IPO has closed. What to do on listing? Should you hold, or sell?

India’s domestic air traffic surged to 16.54 crore passengers in FY25, a 7.6% jump over the previous year and well above pre-COVID levels.

Become a Stock Market PRO!

Join @Mobodaily Telegram Channel Get high-quality swing trading ideas (averaging 10%+ returns), daily market news & crucial IPO reviews.

TFS is perfectly positioned to capture this growth, with a dominant presence in 14 of India’s top 15 airports.

But is the IPO priced for growth, or is the valuation too rich?

This analysis will cut through the noise, examining the financials, risks, and GMP to deliver a clear final verdict on whether this is a first-class investment for your portfolio.

Key Takeaways

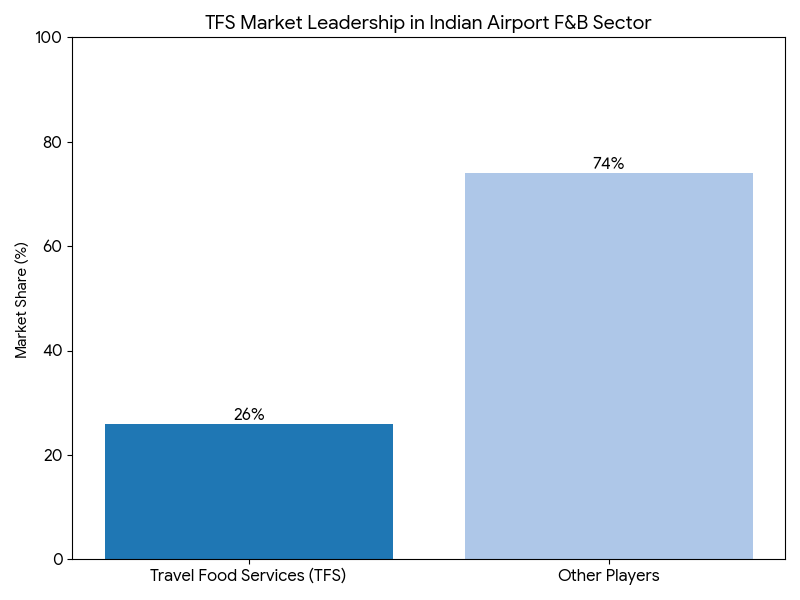

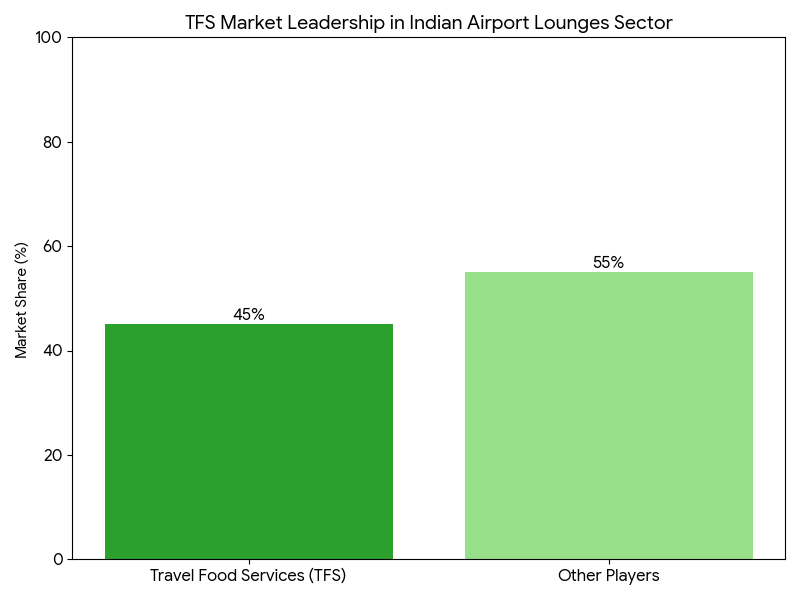

- Strong Market Position: TFS is the market leader, with a ~26% share in airport F&B and a dominant ~45% share in airport lounges, placing it perfectly to benefit from India’s travel boom.

- Robust Financials: The company is consistently profitable, with an impressive 35.5% Return on Equity (RoE) and revenue that grew from ~₹1,067 Cr to ~₹1,688 Cr in the last two years.

- Attractive Valuation: At a P/E multiple of ~50.2x, the IPO appears significantly more reasonably priced compared to listed QSR peers, which trade at P/E ratios of 85x-110x.

Recommended: Crizac Limited IPO GMP, Allotment & Listing – Check Here!

I. Travel Food Services IPO: Key Dates, Price Band, & Issue Details

| IPO Attribute | Details |

|---|---|

| IPO Subscription Dates | July 7, 2025 to July 9, 2025 |

| Price Band | ₹1,045 to ₹1,100 per share |

| Lot Size | 13 Equity Shares |

| Minimum Retail Investment | ₹14,300 (at the upper price band) |

| Total IPO Size | Approx. ₹2,000 Crores |

| Issue Structure | Offer for Sale (OFS) |

| Basis of Allotment Date | July 10, 2025 |

| Initiation of Refunds Date | July 11, 2025 |

| Tentative Listing Date | July 14, 2025 |

⬇️ Download Travel Food IPO Details Snapshot

Did you notice a thing?

The IPO (₹2,000 Crores) is an Offer for Sale (OFS). This means the money will go to existing shareholders, not to the company.

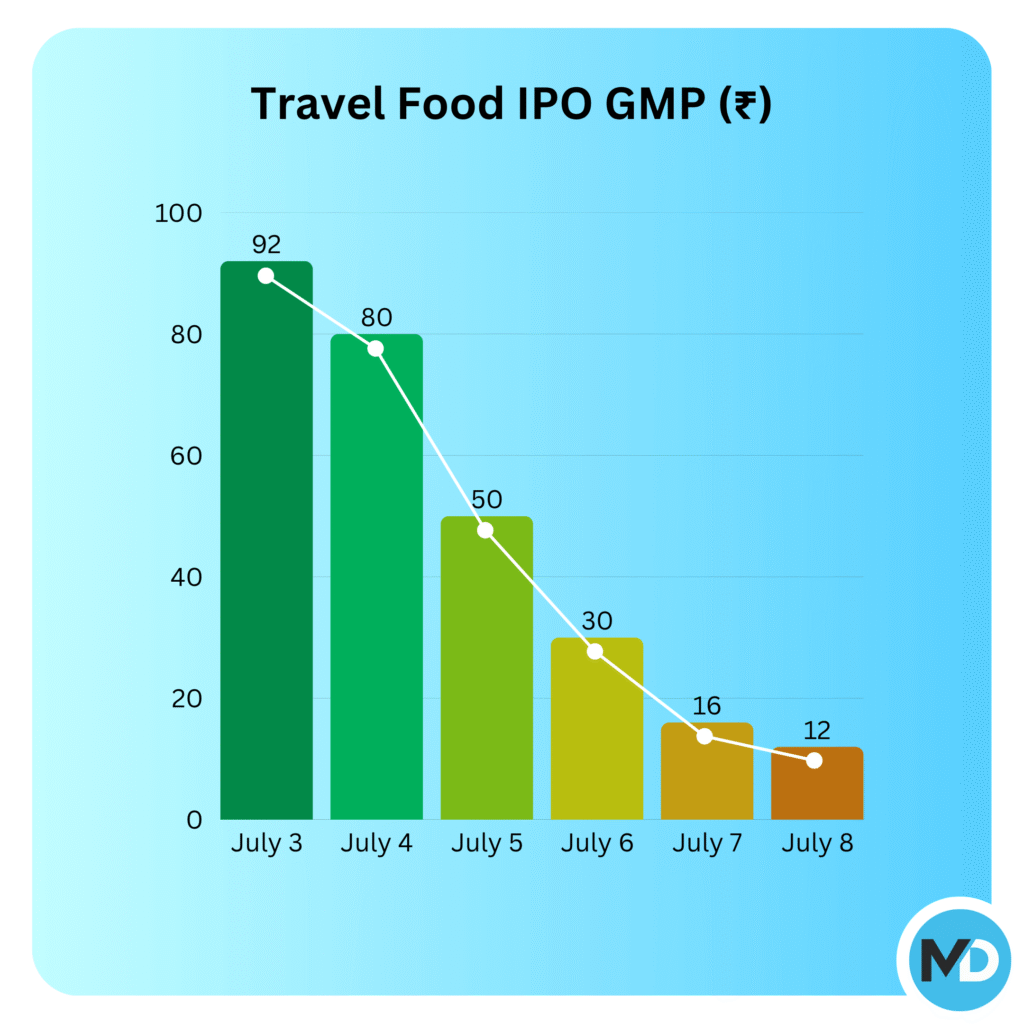

II. Travel Food Services IPO GMP

What is GMP? The Grey Market Premium (GMP) is a key indicator of market sentiment for an upcoming IPO. It’s the premium at which IPO shares are traded unofficially before they are listed on the stock exchanges. A strong GMP often suggests a potential for a strong listing.

Here’s a look at the GMP trend for the Travel Food Services IPO:

| Date | IPO Price | GMP | Estimated Listing Price | Estimated Profit |

|---|---|---|---|---|

| July 9, 2025 | ₹1100 | ₹6 ↓ | ₹1106 (0.55%) | ₹78 |

| July 8, 2025 | ₹1100 | ₹12 ↓ | ₹1112 (1.09%) | ₹156 |

| July 7, 2025 | ₹1100 | ₹16 ↓ | ₹1116 (1.45%) | ₹208 |

| July 6, 2025 | ₹1100 | ₹30 ↓ | ₹1145 (4.09%) | ₹585 |

| July 5, 2025 | ₹1100 | ₹50 ↓ | ₹1150 (4.55%) | ₹650 |

| July 4, 2025 | ₹1100 | ₹80 ↓ | ₹1180 (7.27%) | ₹1040 |

| July 3, 2025 | ₹1100 | ₹92 ↔️ | ₹1192 (8.36%) | ₹1196 |

| July 2, 2025 | ₹1100 | ₹92 ↑ | ₹1192 (8.36%) | ₹1196 |

| July 1, 2025 | ₹1100 | – | – | – |

III. Travel Food Services IPO Allotment Status

Since the Retail Individual Investor (RII) portion was not fully subscribed (it closed at 0.69x), you are guaranteed to receive a firm allotment for the shares you applied for!

There will be no lottery or pro-rata reduction for valid retail applications.

The next step is to simply confirm your allotment status officially.

How to Confirm Your Allotment

The allotment of shares is expected to be finalized on Thursday, July 10, 2025. Here’s how you can check the official confirmation. The registrar for this IPO is MUFG Intime India Private Limited.

Method 1: Check on the Registrar’s Website (MUFG Intime)

- Visit the Website: Go to the MUFG Intime IPO Allotment page: https://in.mpms.mufg.com/Initial_Offer/public-issues.html

- Select the IPO: From the dropdown menu, choose “Travel Food Services Limited”.

- Enter Your Details: You can use your PAN Card Number, Application Number, or DP/Client ID.

- Click Search: Hit the search button, and you will see your confirmed allotment details.

Method 2: Check on the BSE Website

- Go to the BSE Allotment Page: https://www.bseindia.com/investors/appli_check.aspx

- Select Issue Type: Choose ‘Equity’.

- Select Issue Name: From the dropdown menu, select “Travel Food Services Limited”.

- Enter Your Details: Type in your Application Number and PAN Card number.

- Verify & Search: Complete the ‘I’m not a robot’ check and click ‘Search’.

What Happens Next?

Congratulations on your successful allotment! The shares will be credited to your Demat account by July 11, 2025, and the corresponding amount will be debited from your bank account.

IV. Travel Food IPO Listing Day Strategy: Sell or Hold?

Travel Food Services IPO is set to list on Monday, July 14, 2025, presenting a rare and unusual case where different market indicators are telling completely different stories, making the decision complex.

The Conflicting Signals: A Rare Anomaly

- The Bull Case (Reasons to hold)

- Strong Institutional Backing: The QIB portion was oversubscribed a massive 7.70 times, showing huge confidence from the “smart money.”

- Attractive Valuation: The IPO was priced significantly lower than its listed QSR peers.

- The Bear Case (Reasons for Caution)

- Weak Retail & GMP Sentiment: The retail (RII) portion wasn’t fully subscribed, and the Grey Market Premium (GMP) was weak, signaling a lack of broader market excitement.

- 100% Offer for Sale (OFS): The issue is entirely offer for sale, so the funds don’t go to the company.

Your Listing Day Game Plan

Given this uncertainty, your strategy should be based on your original investment goal.

1. If You Applied for Listing Gains:

The weak GMP is a major concern. The risk of a flat or discounted listing is higher than usual for an issue with such strong QIB numbers.

- Watch Pre-Open Market: On Monday at 9:45 AM, see where the share price is settling.

- If the listing is flat or at a discount, as the GMP trend suggests, it’s prudent to exit your position to protect your capital.

- If a Modest Premium Appears (e.g., 5-10%): Consider booking whatever profit is available immediately. Waiting for a bigger pop might be risky.

2. If You Applied for Long-Term Investment:

You are in a much stronger position because you invested in the business, not the listing day hype.

- HOLD: The strong QIB backing validates your long-term thesis. Ignore the listing day volatility and hold the shares. The market’s short-term sentiment doesn’t change the company’s strong fundamentals.

- Look for an Opportunity: A flat or discounted listing could be a golden opportunity for you to buy more shares of a fundamentally sound company at a price even lower than the IPO allotment price.

Final Takeaway: This is a rare case where the “smart money” (QIBs) and the short-term market sentiment (GMP) are at odds. Long-term investors can feel confident, while listing day traders must be extremely cautious on Monday.

V. Travel Food Services IPO Subscription Status

The live subscription figures for an IPO provide a real-time pulse of investor demand. This section will be updated daily at the end of each bidding day to reflect the latest numbers from the BSE and NSE.

Live Subscription Status

| Category | Day 1 (July 7) | Day 2 (July 8) | Day 3 (July 9) |

|---|---|---|---|

| Qualified Institutional Buyers (QIB) | 0.07 | 0.18 | 7.70 |

| Non-Institutional Investors (NII) | 0.06 | 0.24 | 1.58 |

| Retail Individual Investors (RII) | 0.14 | 0.28 | 0.69 |

| Total | 0.10 | 0.25 | 2.88 |

(This table will be updated daily throughout the IPO period)

Day 1 Analysis: A Sluggish Response

The subscription on Day 1 has been extremely sluggish, with the issue being subscribed only 0.10 times overall. This indicates a very cautious, and largely indifferent, start from all investor categories.

- Retail Muted: The retail portion, often the most active on the first day, has seen a very low turnout at just 0.14x.

- Institutions Stay Away: The response from Qualified Institutional Buyers (QIBs) and Non-Institutional Investors (NIIs) is negligible. This lack of interest from the “smart money” is a significant concern and aligns with the consistently falling Grey Market Premium (GMP).

The poor subscription numbers on Day 1 strongly suggest that the market perceives the issue to be overvalued, despite the company’s strong fundamentals.

Day 2 Analysis: The Waiting Game Continues

The second day of bidding failed to bring any significant momentum to the Travel Food Services IPO.

- Institutional Buyers Remain on the Sidelines: A subscription of just 0.18x from the QIBs (smart money) is a major red flag and suggests that large financial institutions are not comfortable with the valuation or the business risks.

- Retail and HNI Interest is Tepid: While the numbers have doubled from Day 1, this is on a very low base. Neither the retail nor the HNI category has managed to get fully subscribed even after two full days of bidding, which is a clear sign of weak demand.

- Outlook for Final Day: The IPO’s fate now hinges entirely on a massive, last-minute push on Day 3. While this sometimes happens, the current trend points towards a very high probability of the issue struggling to get fully subscribed. The sluggish demand aligns with the low Grey Market Premium and signals significant risk for listing day investors.

Day 3 Analysis: The Big Money Has Spoken

The final subscription numbers tell a story of a complete reversal in market sentiment, led by institutional players.

- Massive QIB Turnaround: The most significant development is the QIB category, which went from being virtually ignored to being oversubscribed 7.7 times. This strong institutional demand is a huge vote of confidence in the company’s fundamentals and valuation, and it dramatically improves the IPO’s prospects.

- Retail Remains Skeptical: Interestingly, the Retail (RII) portion did not even get fully subscribed, ending at just 0.69x. This indicates that while the big institutions saw value, individual investors remained cautious, likely due to the high OFS component and declining GMP in the days leading up to the IPO.

- Overall Healthy Subscription: The IPO closed with a respectable total subscription of 2.58 times. While this isn’t a blockbuster number, the strong QIB backing is the most important factor and is a strong positive for the company.

Check back here for daily updates on how the subscription is trending.

VI. About Travel Food Services (The Business Model)

Travel Food Services (TFS) is India’s largest and most prominent operator of food and beverage outlets in travel hubs, particularly airports. If you’ve ever had a coffee, a meal, or used a lounge at a major Indian airport, you have likely been a TFS customer.

As per Travel Food’s DRHP, the company’s business is built on:

TFS’ Two Core Pillars

- Travel Quick Service Restaurants (QSRs): This is their largest segment. TFS operates a massive network of food outlets in airports and on highways. They have a diversified portfolio of 127 brands, which includes:

- International Franchises: Popular global brands like KFC, Pizza Hut, and Subway.

- Regional Indian Brands: Well-known local chains such as Dilli Streat and Hatti Kaapi.

- In-House Brands: Their own proprietary brands like Caféccino and idli.com, designed specifically for travelers.

- Airport Lounges: TFS is also the market leader in operating airport lounges. These lounges cater to premium passengers, offering services like comfortable seating, complimentary food and beverages, and other amenities. They have a presence in major airports across India and even in Malaysia and Hong Kong.

TFS’ Market Leadership

TFS holds a dominant position in its niche. According to a CRISIL report cited in their DRHP, the company commands a ~26% market share in the Indian airport F&B sector and an even more impressive ~45% market share in the airport lounge business, making it the undisputed leader in this space.

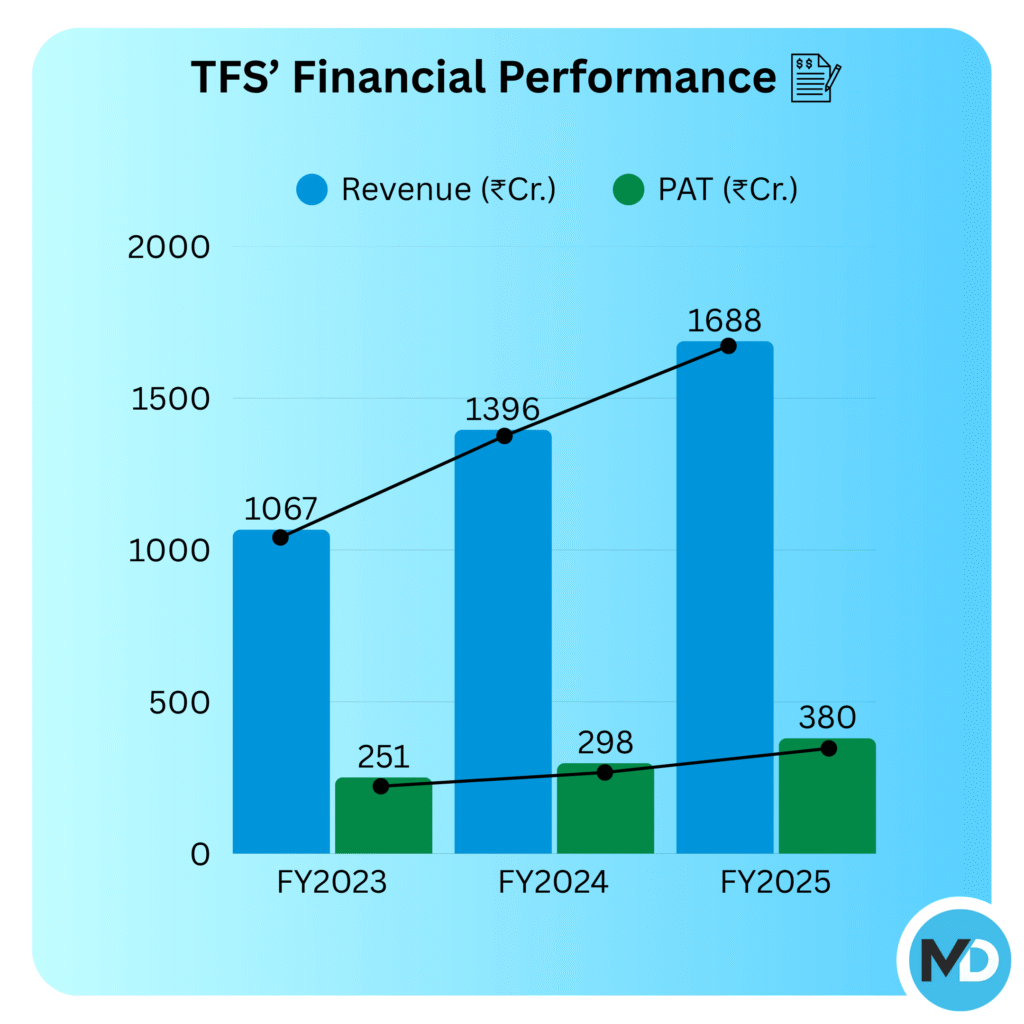

VII. Travel Food Services Financials

A company’s past performance is often the best indicator of its future potential. For Travel Food Services, the numbers tell a story of a strong recovery and consistent growth after the pandemic-induced travel slump.

Here’s a snapshot of their financial health over the last three fiscal years, with all figures sourced from their official RHP.

| Financial Metric | FY2023 | FY2024 | FY2025 |

|---|---|---|---|

| Revenue from Operations (₹ Cr) | 1,067 ↑ | 1,396 ↑ | 1,688 ↑ |

| Profit After Tax (PAT) (₹ Cr) | 251 ↑ | 298 ↑ | 380 ↑ |

| EBITDA (₹ Cr) | 458 ↑ | 550 ↑ | 676 ↑ |

| PAT Margin (%) | 22.8% ↑ | 20.4% ↓ | 21.5% ↑ |

| Return on Net Worth (RoNW %) | 37.8% ↑ | 33.6% ↓ | 35.5% ↑ |

Source: Company data

Financial Analysis: Key Takeaways

- Strong Revenue Growth: The company has demonstrated a robust top-line growth, with revenues climbing steadily from ₹1,067 crore in FY23 to nearly ₹1,700 crore in FY25. This shows their ability to capitalize on the resurgence in travel.

- Consistent & Growing Profits: TFS is a consistently profitable company. Its Profit After Tax (PAT) has grown by over 50% in the last two years, which is a very positive sign for investors.

- High and Stable Margins: The company operates with very healthy and stable margins. A PAT margin consistently above 20% and an EBITDA margin of around 40% are impressive and indicate strong operational efficiency.

- Excellent Return Ratios: A Return on Net Worth (RoNW) of over 35% in the latest fiscal year is exceptional. It signifies that the company is very effective at generating profits from the money invested by its shareholders.

In summary, the financials paint a picture of a strong, well-managed company with a proven ability to grow its revenue and profits in a thriving industry.

VIII. Travel Food Services IPO: Strengths vs. Weaknesses

Here’s a metric-driven look at the strengths and weaknesses to help you make a balanced decision.

| Strengths (The Bull Case) | Weaknesses & Risks (The Bear Case) |

|---|---|

| ✅ Market Leader in a Niche: Dominant ~26% share in airport F&B and ~45% in lounges. | ❌ High Revenue Concentration: Over 85% of revenue comes from just the top 5 airports. |

| ✅ Impressive Profitability: Healthy 35.5% Return on Equity (RoE) and 21.5% PAT Margin in FY25. | ❌ Entirely OFS: 100% of the IPO (₹2,000 Cr) is an Offer for Sale, so the money won’t go to the company. |

| ✅ Strong Industry Tailwinds: The Indian airport QSR market is projected to grow at 17-19% CAGR. | ❌ Dependent on Concessions: Business relies on renewing long-term contracts with airport operators, which is a key risk. |

| ✅ Proven Operational Expertise: High 93.9% contract renewal rate demonstrates strong relationships and execution. | ❌ Vulnerable to Travel Disruptions: Business is directly tied to air passenger traffic, which can be hit by economic or health crises. |

Every investment has two sides of the coin. For Travel Food Services, the opportunity is massive, but the risks are just as real.

IX. Peer Comparison and Valuation Analysis

Valuing Travel Food Services (TFS) requires a careful look at its peers. Since there are no other major listed airport F&B operators, the best comparison is with large, listed Quick Service Restaurant (QSR) players in India.

Here’s how TFS’s valuation stacks up against these established companies based on their FY25 earnings.

| Company | Key Brands | P/E Ratio |

|---|---|---|

| Travel Food Services (at IPO Price) | (Multi-brand) | ~50.2x |

| Devyani International | KFC, Pizza Hut, Costa Coffee | ~85.5x |

| Jubilant FoodWorks | Domino’s, Dunkin’ | ~90.1x |

| Sapphire Foods | KFC, Pizza Hut (Sri Lanka) | ~110.3x |

| Westlife Foodworld | McDonald’s (West & South) | ~78.8x |

(Note: P/E Ratios are based on FY25 earnings. Peer P/E is subject to market changes.)

TFS’ Valuation Analysis:

At the upper price band of ₹1,100, Travel Food Services is asking for a Price-to-Earnings (P/E) multiple of ~50.2 times.

- Attractive Compared to Peers: On the surface, this valuation appears significantly more attractive and at a considerable discount compared to other major QSR players like Devyani, Jubilant, and Sapphire, which trade at much higher P/E ratios (85x – 110x).

- Justified Premium?: One could argue that TFS, with its market leadership, higher operating margins, and strong return ratios, deserves a premium valuation. However, the IPO is being priced at a level that seems to leave some value on the table for investors when compared to the broader QSR industry.

- The Caveat: The key risk factor is TFS’s high dependency on the travel sector, which is more volatile than the general QSR market.

In conclusion, the valuation for the TFS IPO seems reasonable, and perhaps even attractive, when compared to its listed peers in the food service industry.

X. Travel Food Services IPO: Final Verdict

Travel Food Services presents a compelling but complex case.

✅ On one hand, we have a clear market leader in a booming travel sector, backed by stellar financials, high profitability, and excellent return ratios. The valuation, at a P/E of ~50x, appears significantly more attractive than its listed QSR peers.

❌ On the other hand, the IPO is an Offer for Sale (OFS), and the declining Grey Market Premium (GMP) suggests that the initial market excitement has cooled off considerably.

Here is our final verdict based on your investment goals:

For Long-Term Investors: APPLY ✅

The fundamental story is very strong. TFS is a profitable, well-managed company with a dominant position in a high-growth industry.

The attractive valuation relative to its peers provides a good entry point for investors who are willing to hold for the long term and believe in the continued growth of travel in India. The OFS is a drawback, but the underlying business is robust.

For Listing Gains: APPLY with Caution ⚠️

The declining GMP, which now indicates a modest premium of just 4-5%, is a significant concern. While the attractive valuation could still lead to a decent listing, the momentum is not in its favor.

Investors applying purely for listing day gains should be aware that the returns may not be spectacular and should apply with caution.

Download Final Verdict Snapshot ⬇️

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Investing in IPOs carries significant risk. Please consult with a qualified financial advisor before making any investment decisions. The author is not responsible for any financial losses.

- 10+ Best SEBI-Registered Telegram Channels 2026 - February 25, 2026

- Top 5 SEBI-Registered Telegram Channels For Option Trading [2026] - February 12, 2026

- 10 Best Nifty 50 Options Trading Telegram Channels [2026] - February 12, 2026

Discover more from Mobodaily

Subscribe to get the latest posts sent to your email.