Anxiously waiting to check your NSDL IPO allotment status?

The wait is almost over!

Become a Stock Market PRO!

Join @Mobodaily Telegram Channel Get high-quality swing trading ideas (averaging 10%+ returns), daily market news & crucial IPO reviews.

The results for the massive NSDL IPO are expected to be released late tonight (August 4th).

We’ve got the direct link to the official registrar, Link Intime, and a simple guide on how to check your status using your PAN card.

Find out in minutes if you were allotted shares in the backbone of India’s stock market.

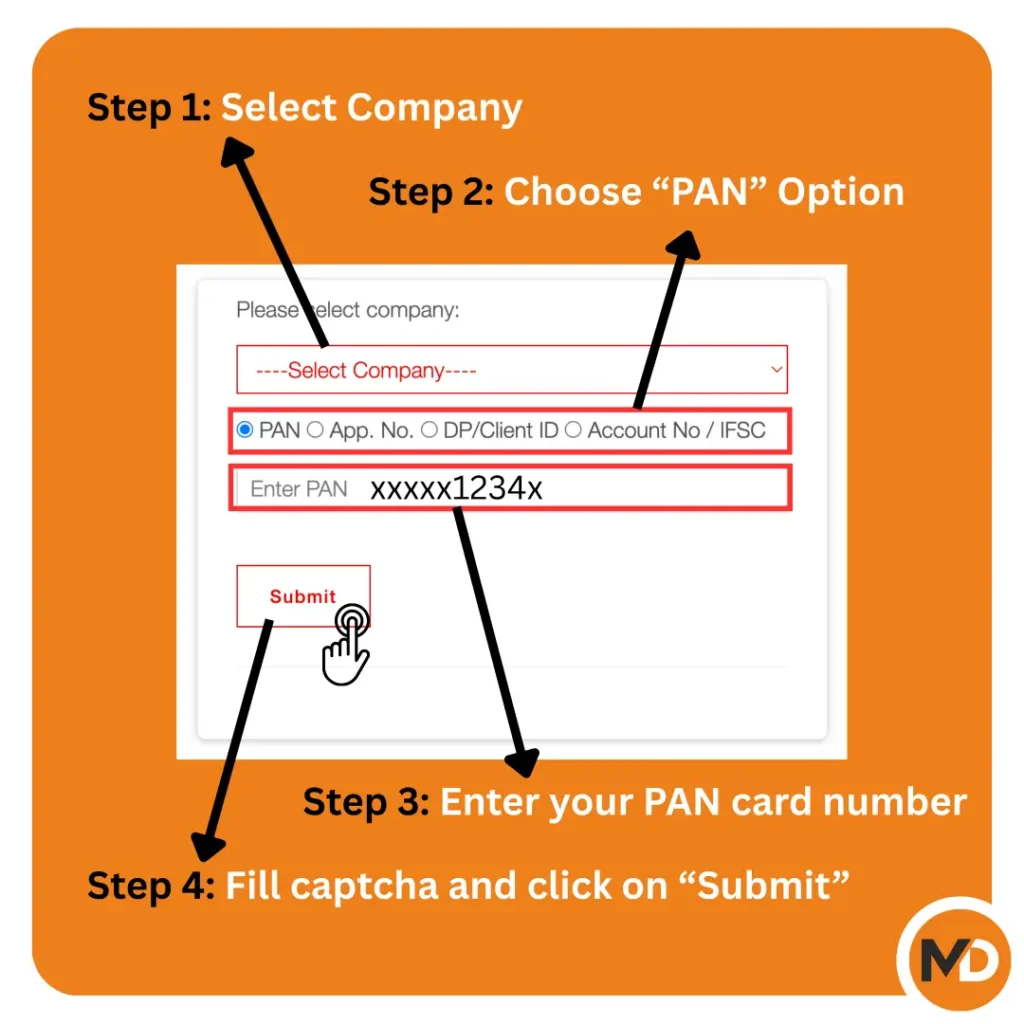

How to Check Your NSDL IPO Allotment Status

The official registrar for the NSDL IPO is Link Intime India Pvt Ltd. The status will be updated on their official website later this evening.

➡️ Direct Link to Check Allotment: Click Here for Link Intime Allotment Status

Step-by-Step Guide (Using PAN Card):

- Click on the direct link provided above.

- From the dropdown menu, select “National Securities Depository Ltd”. (Note: This option may not appear until the status is officially live tonight).

- The page will default to the PAN option. Enter your 10-digit PAN Number accurately.

- Enter the security Captcha code shown on the screen.

- Click the “Submit” button.

Your allotment status will then be displayed on the screen.

Frequently Asked Questions (FAQ)

Q: The NSDL option isn’t in the list yet. What does that mean?

A: It means the allotment status is not yet live. The data is usually uploaded between 7 PM and 11 PM on the allotment date. Keep checking the link periodically.

Q: What does “No records found” mean after I submit?

A: Unfortunately, this means you were not allotted any shares in the IPO.

Q: I wasn’t allotted shares. When will I get my refund?

A: The refund process and the unblocking of your funds will begin on August 5th. You should see the amount back in your account by the evening of August 5th or the next day.

1. NSDL IPO: Key Dates and Details*

| IPO Detail | Information |

|---|---|

| IPO Subscription Dates | July 30, 2025 – August 1, 2025 |

| Allotment Date | August 4, 2025 |

| Refund/Share Credit | August 5, 2025 |

| Listing Date | August 6, 2025 |

| Price Band | ₹760 – ₹800 per share |

| Lot Size | 18 Shares |

| Minimum Investment | ₹14,400 (for 1 Lot at the upper price band) |

| Total Issue Size | ₹4,011.60 Crores |

| Issue Type | 100% Offer For Sale (OFS) |

| IPO Registrar | Link Intime India Pvt Ltd |

| Tentative Listing Date | Wednesday, August 6, 2025 |

| Listed On | BSE, NSE |

2. What is NSDL and Why is it Important?

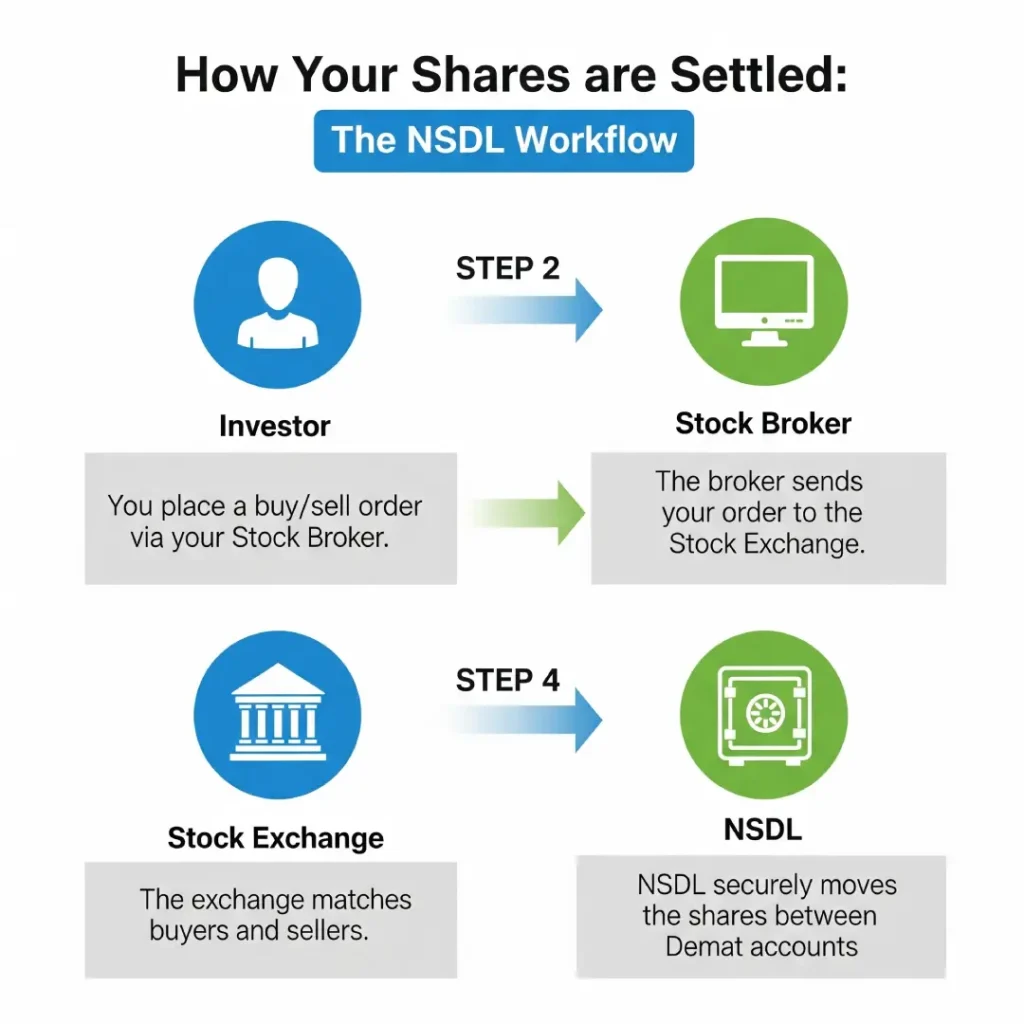

Most investors have never interacted with NSDL directly, yet it plays a critical role in every single stock market transaction. So, what exactly is it?

2.1. Think of NSDL as the high-security digital “Locker” or “Bank” for all your shares.

When you buy shares of a company like Reliance or TCS, you don’t get a physical paper certificate anymore. Instead, NSDL holds those shares for you electronically in your Demat account. They ensure your shares are safe, secure, and can be transferred instantly when you decide to sell.

In India, this vital function is handled by just two government-regulated entities: NSDL and CDSL.

This duopoly means there is almost zero competition, creating a massive protective “moat” around their business that is nearly impossible for newcomers to penetrate.

As India’s first and largest depository, NSDL is a titan of the industry.

Investing in its IPO isn’t just buying a company’s stock; it’s like buying a piece of the core infrastructure that powers India’s entire capital market system.

3. NSDL vs. CDSL: A Head-to-Head Comparison

To truly understand if the NSDL IPO is a good opportunity, we must compare it to its only rival, the already-listed CDSL. Here’s how the two stack up based on official filings and recent market data:

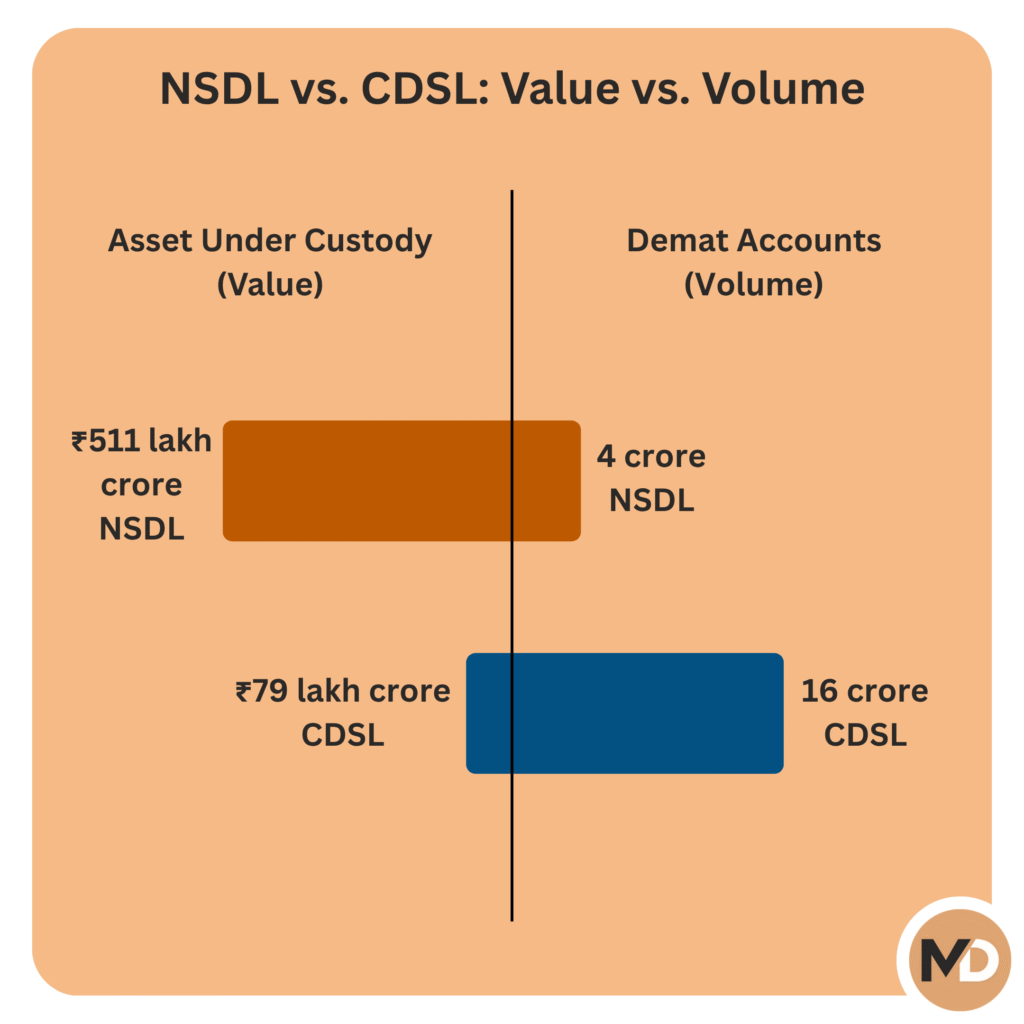

3.1. The Market Share Battle: Value vs. Volume

| Parameter | NSDL (The IPO Candidate) | CDSL (The Listed Peer) |

|---|---|---|

| Demat Accounts (Volume) | ~4.0 Crore | ~15.9 Crore (Leader) |

| Assets Under Custody (Value) | ~₹511 Lakh Crore (Leader) | ~₹79 Lakh Crore |

- NSDL: The Institutional Giant (Leader by Value) NSDL is the undisputed king when it comes to the value of assets held. It manages an astronomical ~₹511 Lakh Crore in Assets Under Custody (AUC). This is because it is the preferred depository for high-value institutional clients like FIIs, Mutual Funds, and large corporations.

- CDSL: The Retail Champion (Leader by Volume) CDSL, powered by its partnerships with discount brokers, dominates the retail space. It holds a staggering ~15.9 Crore Demat accounts, compared to NSDL’s ~4 Crore accounts. Its strength lies in its vast number of individual investors.

This creates a clear picture: NSDL holds the value, while CDSL holds the volume.

3.2. Financial Performance & Valuation

| Parameter | NSDL (The IPO Candidate) | CDSL (The Listed Peer) |

|---|---|---|

| FY25 Revenue (Approx.) | ~₹1,500 Cr (Leader) | ~₹1199 Cr |

| FY25 Profit (Approx.) | ~₹343 Cr | ~₹526 Cr (Leader) |

| Profit Margin | ~23% | ~44% (Leader) |

| Valuation (P/E Ratio) | ~46.6x (at IPO price) | ~47.5x (at current market price) |

3.3. The Conclusive Verdict: NSDL or CDSL?

After digging into the numbers, here’s the ultimate takeaway.

While NSDL is the bigger company by the sheer value of assets it holds, CDSL is actually the more profitable company, with a much higher profit margin.

Crucially, the NSDL IPO is priced at a valuation (~46.6x P/E) that is almost identical to CDSL’s current market price.

3.3.1. What This Means for You:

This IPO isn’t a discount. It’s a fairly priced entry into the market’s foundational “whale.” You’re not getting a bargain, but you are getting a solid, stable business at a price the market thinks is right.

The choice is yours:

- NSDL: The stable, high-value, institutional leader.

- CDSL: The hyper-profitable, retail-focused champion.

For long-term stability, the NSDL IPO is a solid ‘Subscribe’

4. Strengths and Risks of the NSDL IPO

Like any investment, the NSDL IPO has clear advantages and potential downsides. For a last-minute decision, it’s crucial to understand both sides of the coin. Here’s a balanced look.

(We’ll start with a summary table for quick scanning)

| ✅ Key Strengths (The Bull Case) | ⚠️ Key Risks (The Bear Case) |

|---|---|

| Market Leader in a Duopoly | 100% Offer For Sale (OFS) |

| Critical Financial “Utility” | Premium Valuation (~47x P/E) |

| Stable, Scalable Business Model | Performance Tied to Market Health |

| Consistent Financial Growth | Subject to Regulatory Changes |

4.1. ✅ Key Strengths Explained

- Market Leader in a Duopoly: This is NSDL’s biggest advantage. With only one other competitor (CDSL), the barriers to entry for any new company are almost impossibly high. This protects their business and profits.

- Critical Financial Infrastructure: NSDL is not just a company; it’s a utility for the stock market. It’s an essential service that the entire financial system relies on, providing incredible stability.

- Stable & Scalable Business: As the Indian stock market grows and more people invest, NSDL’s revenue naturally grows with it, without needing massive new investments.

- Consistent Financials: NSDL has a proven track record of growing its revenue and profits steadily over the years.

4.2. ⚠️ Key Risks & Concerns Explained

- Premium Valuation: While it’s cheaper than its peer CDSL, a P/E ratio of ~47x is still not cheap. You are paying a premium price for the company’s stability and market position.

- Market-Linked Performance: NSDL’s revenue is linked to market activity. A prolonged bear market could lead to fewer transactions and slower growth.

- Regulatory Risks: Being a critical market intermediary, NSDL is always under the purview of SEBI. Any changes to regulations or fee structures could impact its business.

4.3. Understanding the 100% Offer For Sale (OFS)

This is a crucial point for retail investors. In this IPO, the company itself is not raising any new money. The entire ₹4,011 crore is going to the existing shareholders (like major banks and institutions) who are selling part of their stake.

This means the funds aren’t being used for NSDL’s future growth or expansion. While this is common for mature, profitable companies that don’t need fresh capital, it’s an important factor to know before you invest.

5. The Final Verdict: So, What Should You Do?

Let’s cut to the chase and answer the questions you’re likely asking right now.

“So, should you apply? What’s the final call?”

The verdict for you: ✅ NSDL IPO is a strong ‘Subscribe’ candidate if you are a long-term investor.

✅ “What makes it a good choice for your portfolio?”

- You’re buying into a market leader that has almost no competition.

- You’re choosing a “safer” bet – a stable, foundational part of the entire stock market.

- You’re getting a better price. The IPO is valued more attractively than its only competitor, CDSL.

⚠️ “Are there any catches you should be aware of?”

- Remember, this is a “buy and hold” stock, not a “get rich quick” lottery ticket. The primary benefit is long-term stability, not massive listing day fireworks.

- Also know that the IPO money goes to existing owners, not into the company for new projects.

⚠️ Final Reminder: The application window closes Today 5 PM, August 1st!

6. How to Apply for the NSDL IPO (With Visuals)

6.1. Get Ready! ✅

Before you start, make sure you have these two things ready to go:

- A Demat & Trading Account (with a broker like Zerodha, Groww, etc.)

- A UPI ID (from GPay, PhonePe, etc.) linked to your bank account.

6.2. Fill the Application

This is the easy part. Just follow these clicks:

- Log in to your brokerage app and tap on the IPO Section.

- Select “NSDL” from the list of open IPOs.

- In the bid section: Enter 1 Lot (which is 18 shares). IMPORTANT: Check the box for “Cut-off Price”. This maximizes your chances of allotment!

- Confirm your UPI ID and hit Submit.

6.3. The FINAL, Crucial Step!

Don’t forget this! Your application isn’t complete until you do this:

- Open your UPI app (GPay, PhonePe, etc.).

- You’ll see a payment request (mandate) for ₹14,400. You MUST APPROVE it.

- The money will only be blocked in your account, not debited. It’s totally safe!

And that’s it! You’re all set. Now you just wait for the allotment news.

Conclusion: Your Final Takeaway

So, there you have it! The NSDL IPO is a rare opportunity to invest in the core engine of the Indian stock market.

Here’s the entire analysis, boiled down to three simple points:

- ✅ It’s a High-Quality Business: Think of it as a safe, foundational stock for your portfolio. It’s the market leader with almost no competition.

- ✅ The Price is Right: The IPO valuation is attractive, especially when you compare it to its only competitor, CDSL.

- ✅ It’s a Long-Term Play: This is an ideal stock for those looking to buy and hold a solid company for years to come.

The clock is ticking, and the final decision is yours. This is one of the most fundamentally strong IPOs to hit the market this year.

What’s your final call? Are you applying before the window closes tomorrow? Share your thoughts in the comments below!

(As always, this is our analysis for educational purposes. Please do your own research before investing. Happy investing!)

- 10+ Best SEBI-Registered Telegram Channels 2026 - February 25, 2026

- Top 5 SEBI-Registered Telegram Channels For Option Trading [2026] - February 12, 2026

- 10 Best Nifty 50 Options Trading Telegram Channels [2026] - February 12, 2026

Discover more from Mobodaily

Subscribe to get the latest posts sent to your email.