Applied for the Regaal Resources IPO? You’re not alone.

The retail portion was oversubscribed by a massive 58 times, so the competition for shares was intense.

Become a Stock Market PRO!

Join @Mobodaily Telegram Channel Get high-quality swing trading ideas (averaging 10%+ returns), daily market news & crucial IPO reviews.

The wait is almost over.

The allotment status is expected on Monday, August 18th.

This guide has the direct link and the exact steps to check your status using your PAN card the moment it’s live.

Missed the Allotment? Apply For Vikram Solar IPO [Date, Details, Lot Size,…]

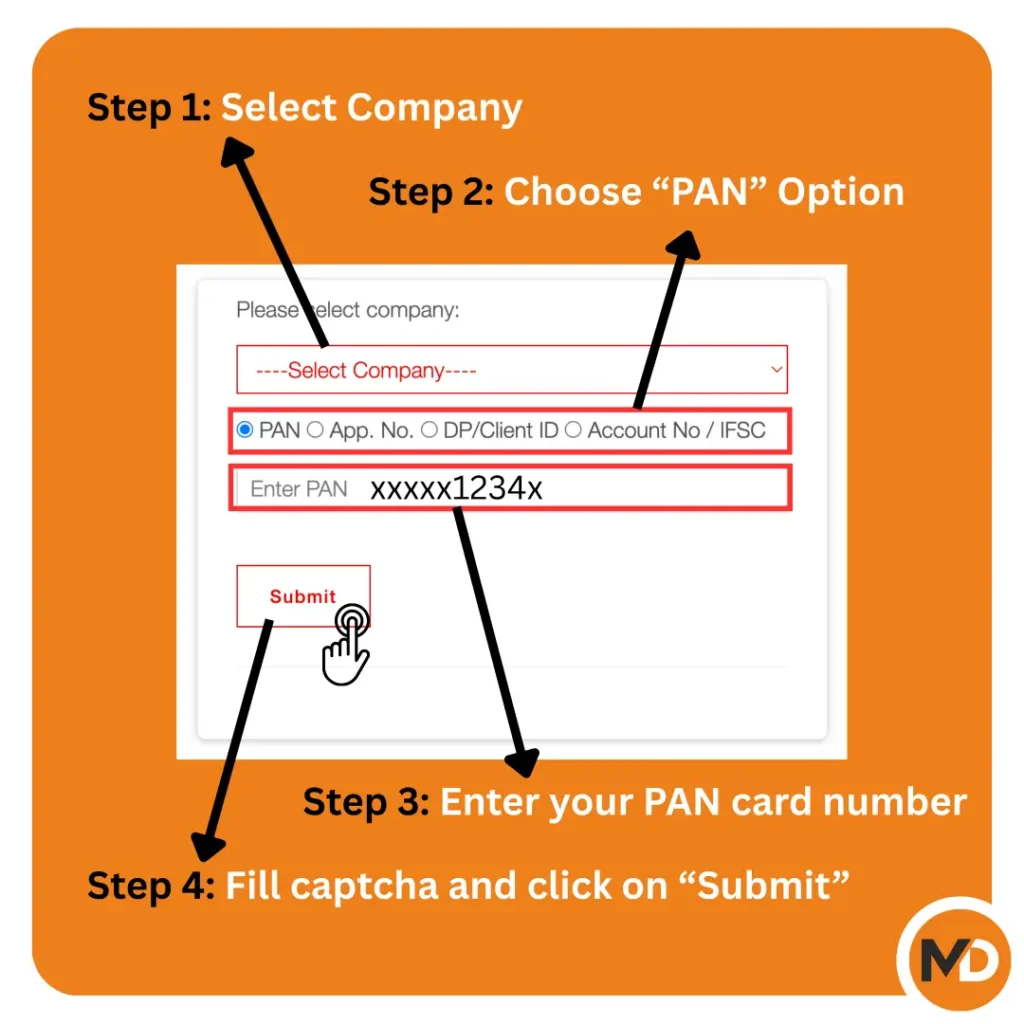

How to Check Your Regaal Resources IPO Allotment Status

The official registrar for the Regaal Resources IPO is MUFG Intime India Pvt Ltd. The results are expected updated on their official website late in the evening on Monday, August 18th.

➡️ Direct Link to Check Allotment: Click Here for MUFG (Link Intime) Allotment Status

Step-by-Step Guide (Using Your PAN Card):

- Click on the direct link provided above.

- On the allotment page, find the dropdown menu and select “Regaal Resources Limited”1.

- By default, the “PAN” option will be selected. Enter your 10-digit Permanent Account Number (PAN).

- Enter the Captcha code for verification.

- Click the “Submit” button.

Your allotment status will then be displayed on the screen, showing how many shares you have been allotted.

➡️ Follow me on X (Twitter) to get realtime updates on the allotment status and listing day action!

Frequently Asked Questions (FAQ)

Q: The company name is not in the list. What do I do?

A: This is normal. It just means the allotment results are not yet live. The data is usually uploaded late in the evening (typically after 7 PM) on the allotment date. Just keep checking the link periodically.

Q: It says “No records found.” What does that mean?

A: Unfortunately, because the retail portion was oversubscribed 58 times, this means you were not one of the lucky applicants selected in the lottery.

Q: I didn’t get any shares. When will I get my money back?

A: The process to unblock your UPI mandate fund will begin on Tuesday, August 19th. You should see the amount reflected in your bank account by that evening or the next day.

Regaal Resources IPO: At a Glance

For those in a hurry, here are the essential details pulled from the official Red Herring Prospectus (RHP). Remember, the deadline is today.

| IPO Detail | Information |

|---|---|

| IPO Subscription Dates | August 12, 2025 – August 14, 2025 (Last Day) |

| Price Band | ₹96 – ₹102 per share |

| Lot Size | 144 Shares |

| Minimum Investment | ₹14,688 (for 1 Lot at the upper price band) |

| Total Issue Size | ₹306 Crores |

| Issue Type | Fresh Issue (₹210 Cr) + Offer for Sale (₹96 Cr) |

| Tentative Listing Date | Wednesday, August 20, 2025 |

| Listed On | BSE, NSE |

Regaal Resources IPO: Subscription Status

As of the final day, the IPO has seen incredible demand across all investor categories. This massive oversubscription is a strong positive signal from the market.

| Investor Category | Subscription (Times Over) |

|---|---|

| Qualified Institutional Buyers (QIB) | 5.30x |

| Non-Institutional Investors (NII/HNI) | 175.85x |

| Retail Individual Investors (RII) | 37.64x |

| Total | 58.02x |

Key Takeaway: When big investors (QIBs and NIIs) oversubscribe an issue by such high multiples, it signals strong institutional confidence, which often translates to a successful listing. The high retail interest further fuels this momentum.

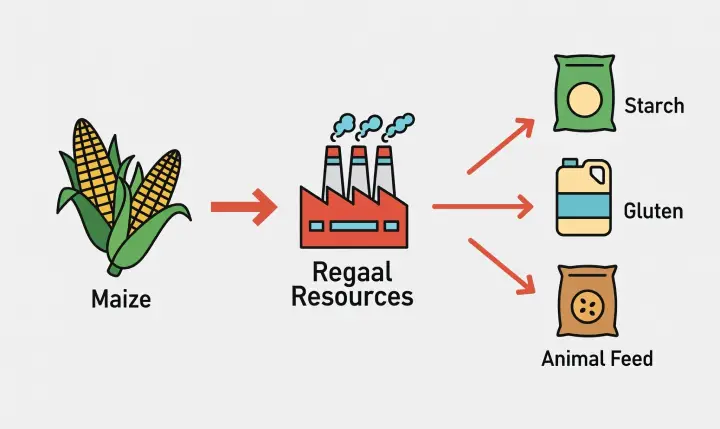

What Does Regaal Resources Do?

Regaal Resources takes locally sourced maize (corn) and processes it into various high-value products.

Think of it like a specialized food processor for industrial needs. Their main outputs include:

- Maize Starch: Used in paper, textiles, and food industries.

- Maize Gluten: A protein-rich ingredient for animal feed.

- Maize Fibre: Used in animal feed and some food products.

Their manufacturing plant is strategically located in Bihar, giving them access to a large supply of maize, which helps keep their raw material costs competitive.

Regaal Resources IPO: Financial Performance

The excitement around this IPO is backed by some truly explosive financial performance. The numbers from their official filings show a business hitting a massive growth spurt.

Here’s a quick look at their revenue and profit trend over the last three years:

| Financial Year | Revenue (₹ Cr.) | Profit After Tax (₹ Cr.) |

|---|---|---|

| FY2023 | 488 | 16.7 |

| FY2024 | 600 | 22.1 |

| FY2025 | 915 ⬆️ | 47.7 ⬆️ |

Key Takeaway:

The trend is undeniable. In a single year (FY24 to FY25), the company grew its revenue by over 50% and more than doubled its net profit.

This explosive growth is the single biggest reason for the massive oversubscription and high GMP.

While the company does have significant debt (which it plans to repay with IPO funds), this powerful financial momentum is why investors are so bullish on its listing.

Regaal Resources IPO: Pros and Cons

Here’s a rapid breakdown of the good and the bad to help you make a final decision.

| ✅ Strengths (The Bull Case) | ⚠️ Risks (The Bear Case) |

|---|---|

| Explosive Financial Growth | High Debt Levels |

| Overwhelming Demand (50x+ Subscribed) | High Customer Concentration |

| Strong Grey Market Premium (~33%) | Commodity Price Risk (Maize) |

| Strategic Location (Reduces Costs) | IPO Proceeds Used for Debt Repayment |

Regaal Resources IPO: Final Verdict

✅ A Clear ‘Subscribe’ for Listing Gains

With just hours left before the deadline, the data points to a clear and confident conclusion.

The Overwhelming Positive Signals:

- Massive Demand: The IPO has been oversubscribed by more than 50 times. This is a powerful signal of high demand from institutional investors.

- Surging GMP: The Grey Market Premium, indicating a potential 33% listing gain, is strong and has been rising.

- Explosive Growth: The company’s financials are phenomenal, with profits more than doubling in the last year.

The Long-Term Picture:

While the company’s high debt is a factor for long-term investors to watch, the IPO proceeds will significantly strengthen its financial position by reducing that debt.

Our Verdict: ✅ Subscribe. The short-term indicators are overwhelmingly positive for a strong debut on listing day.

(Disclaimer: This analysis is for informational purposes only and is not financial advice. Please do your own research before investing.)

Regaal Resources IPO: FAQs

Here are quick answers to the most common questions investors are asking about the Regaal Resources IPO.

Q1: What is the Grey Market Premium (GMP) for the Regaal Resources IPO?

As of the last day of bidding (August 14th), the GMP for Regaal Resources is strong, indicating a potential listing gain of around 33% over the IPO price.

Q2: When will the Regaal Resources IPO allotment status be announced?

The allotment of shares is expected to be finalized on Monday, August 18, 2025. You will be able to check your status on the registrar’s website on that day.

Q3: Who is the registrar for the Regaal Resources IPO?

The official registrar for the IPO is MUFG Intime India Private Limited (formerly known as Link Intime).

Q4: When is the listing date for Regaal Resources?

The stock is tentatively scheduled to be listed on the BSE and NSE on Wednesday, August 20, 2025.

Q5: What is the minimum investment required for the Regaal Resources IPO?

Retail investors need to apply for a minimum of one lot, which consists of 144 shares. At the upper price band of ₹102, the minimum investment is ₹14,688.

- This option will only appear after the status is officially declared live by the registrar. ↩︎

- 10+ Best SEBI-Registered Telegram Channels 2026 - February 25, 2026

- Top 5 SEBI-Registered Telegram Channels For Option Trading [2026] - February 12, 2026

- 10 Best Nifty 50 Options Trading Telegram Channels [2026] - February 12, 2026

Discover more from Mobodaily

Subscribe to get the latest posts sent to your email.