The subscription window for the highly anticipated CP Plus (Aditya Infotech) IPO has officially closed, and after days of waiting, the big moment is finally here.

Thousands of retail investors applied, and the only question on everyone’s mind today is:

Become a Stock Market PRO!

Join @Mobodaily Telegram Channel Get high-quality swing trading ideas (averaging 10%+ returns), daily market news & crucial IPO reviews.

“Did I get the shares?”

This post has been updated with the latest information to help you find the answer. Below, you will find the direct link and a simple, step-by-step guide to check your CP Plus IPO allotment status right now.

➡️ Missed out on the CP Plus IPO? The NSDL IPO is closing soon! Read our full analysis here.

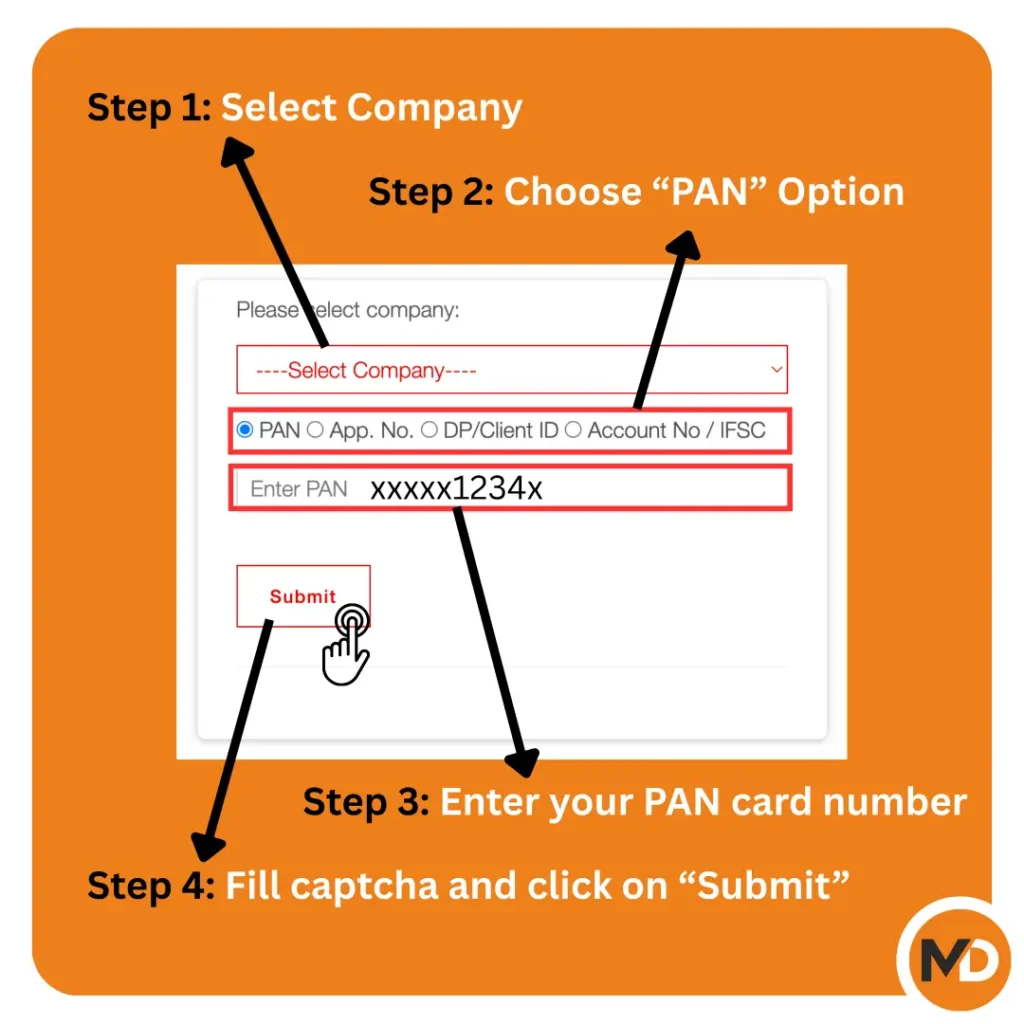

CP Plus (Aditya Infotech) IPO Allotment Status: Live Link & Guide

The wait is finally over! The allotment status for the CP Plus (Aditya Infotech) IPO is expected to be announced today, August 1st. Here is the direct link and a simple step-by-step guide to check if you have been allotted shares.

➡️ Direct Link to Check Allotment Status

The official registrar for the IPO is Link Intime India Pvt Ltd. You can check your status on their official website:

Click Here for Link Intime Allotment Status

Note: The company name “Aditya Infotech Ltd” might take a few hours to appear in the dropdown menu on the day of allotment. Keep checking.

You can follow me on X to get realtime updates:

Step-by-Step Guide to Check Your Status on Link Intime

- Click on the direct link provided above.

- From the dropdown menu under “Select Company,” choose “Aditya Infotech Ltd”.

- Choose one of the three options to enter your details:

- PAN Card (Easiest and most common)

- Application Number

- DP Client ID

- Enter your details accurately in the selected field.

- Enter the security Captcha code shown on the screen.

- Click the “Submit” button.

Your allotment status will be displayed on the screen. It will either show the number of shares you have been allotted or a “No records found” message.

Frequently Asked Questions (FAQ)

This is the part the big news sites often forget.

Q: The website is slow or not opening. What should I do?

A: This is very common due to heavy traffic on allotment day. Please be patient and try refreshing the page after 15-20 minutes.

Q: What does it mean if it shows “No records found”?

A: Unfortunately, this means you were not allotted any shares in the lottery draw because the IPO was heavily oversubscribed.

Q: I wasn’t allotted shares. When will I get my money back?

A: The process of unblocking your funds (your refund) in your bank account will begin today. You should see the block removed from your account by this evening or the next business day at the latest.

1. Aditya Infotech IPO: At a Glance

For those in a hurry, here are all the essential details pulled directly from the company’s official Draft Red Herring Prospectus (DRHP).

The IPO is live right now, and today (July 30th) is the second day of the subscription window.

| IPO Detail | Information |

|---|---|

| IPO Subscription Dates | July 29, 2025 – July 31, 2025 (Closes Tomorrow) |

| Price Band | ₹640 – ₹675 per share |

| Lot Size | 22 Shares |

| Minimum Investment | ₹14,850 (for 1 Lot at the upper price band) |

| Total Issue Size | ₹1,300 Crores |

| ↳ Fresh Issue (Money to Company) | ₹500 Crores |

| ↳ Offer for Sale (Money to Existing Shareholders) | ₹800 Crores |

| Listing On | BSE, NSE |

| Tentative Listing Date | August 5, 2025 |

| Retail Investor Quota | Just 10% of the Net Issue |

| Subscription Status (Day 2, ~2 PM) | Heavily oversubscribed. The retail portion subscribed over 25 times. |

*Subscription data is compiled from major financial news outlets and is subject to change.

2. What is Aditya Infotech? The Powerhouse Behind CP Plus

So, what does this company actually do? To put it simply, Aditya Infotech is the dominant force in India’s video security and surveillance market.

They are the company behind the vast array of CP Plus products—from the CCTV cameras on our streets to advanced AI-based security systems for large enterprises.

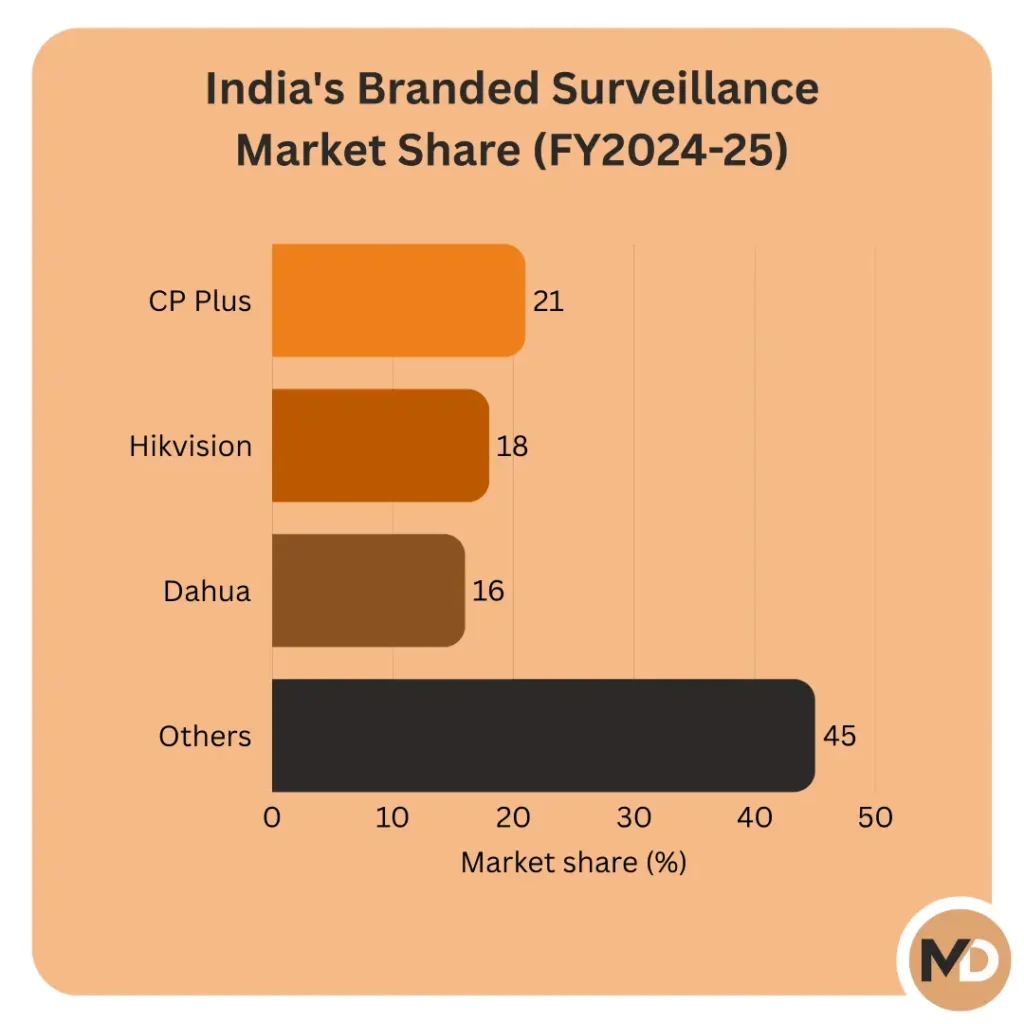

2.1. Visualizing Their Market Leadership

Aditya Infotech isn’t just a participant in the market; it leads it.

The bar chart below, based on industry reports cited in their RHP, clearly illustrates their position as the largest single brand in India’s branded surveillance market:

Holding the largest single brand market share gives them a significant competitive advantage and highlights their strong presence in the Indian security landscape.

2.2. A ‘Make in India’ Story

This market leadership is further strengthened by their commitment to domestic manufacturing. Their facility in Kadapa, Andhra Pradesh, is the 3rd largest CCTV and surveillance equipment plant in the world, a testament to the ‘Make in India’ initiative and a key part of their growth story.

3. Strengths vs. Risks: The Balanced View

Every investment has two sides. Here is a quick summary of the bull and bear case for the Aditya Infotech IPO, followed by a more detailed explanation of each point. All information is based on the company’s official Draft Red Herring Prospectus (DRHP).

| ✅ Strengths (The Bull Case) | ⚠️ Risks (The Bear Case) |

|---|---|

| Market Leader with 21% share | Aggressive valuation (high P/E ratio) |

| Powerful “CP Plus” brand recognition | FY25 Profit inflated by a one-time gain |

| World-class ‘Make in India’ manufacturing | High dependence on components from China |

| Positioned in a high-growth industry | Very low chance of allotment due to 10% retail quota |

| Plans to repay ₹375 crores of debt from IPO funds | Intense and growing competition in the market |

3.1. ✅ Key Strengths Explained:

- Market Dominance: As stated in their DRHP, Aditya Infotech is the undisputed market leader with a 21% share of India’s branded security surveillance market. In business, being #1 is a powerful advantage.

- Exceptional Brand Recall: The “CP Plus” brand is a massive, often underestimated asset. This recognition allows for better pricing power and customer trust compared to lesser-known competitors.

- A ‘Make in India’ Powerhouse: The company’s DRHP details its world-class manufacturing facility in Kadapa. Being the 3rd largest of its kind globally gives them immense scale and aligns perfectly with India’s push for self-reliance.

- Strong Industry Tailwinds: The demand for security and surveillance is not slowing down. As a market leader, Aditya Infotech is perfectly positioned to ride this wave of growth.

- Strengthening the Balance Sheet: The company plans to use ₹375 crores from the IPO’s fresh issue to repay debt. This is a positive sign, as it will reduce interest costs and improve profitability in the long run.

3.2. ⚠️ Key Risks Explained:

- Aggressive Valuation: The IPO is priced at a premium. As we’ll explore in the next section, when you look past certain one-time accounting gains, the valuation appears steep compared to its actual operating profit.

- The “Exceptional Gain” Illusion: The company’s FY25 profit looks incredibly impressive at ₹351 crore. However, the financial statements in the RHP reveal this includes a ~₹249 crore one-time, non-cash gain. The actual profit from operations is significantly lower, a critical detail every investor must know.

- High Dependence on China: The “Risk Factors” section of the RHP highlights that while the products are assembled in India, the company still relies heavily on importing key components and raw materials, particularly from China. Any geopolitical tension or supply chain disruption is a significant risk.

- The Allotment Lottery: The retail quota is only 10%. With the retail portion already oversubscribed by more than 25 times as of today (July 30th), the probability of receiving an allotment is extremely low.

- Intense Competition: The electronics and security market is fiercely competitive, with both domestic and international players constantly vying for market share.

4. Financials & Valuation: Is the IPO Overpriced?

Now that we understand the company’s business and market position, let’s look at the numbers. All data here is sourced from the company’s official Red Herring Prospectus (RHP).

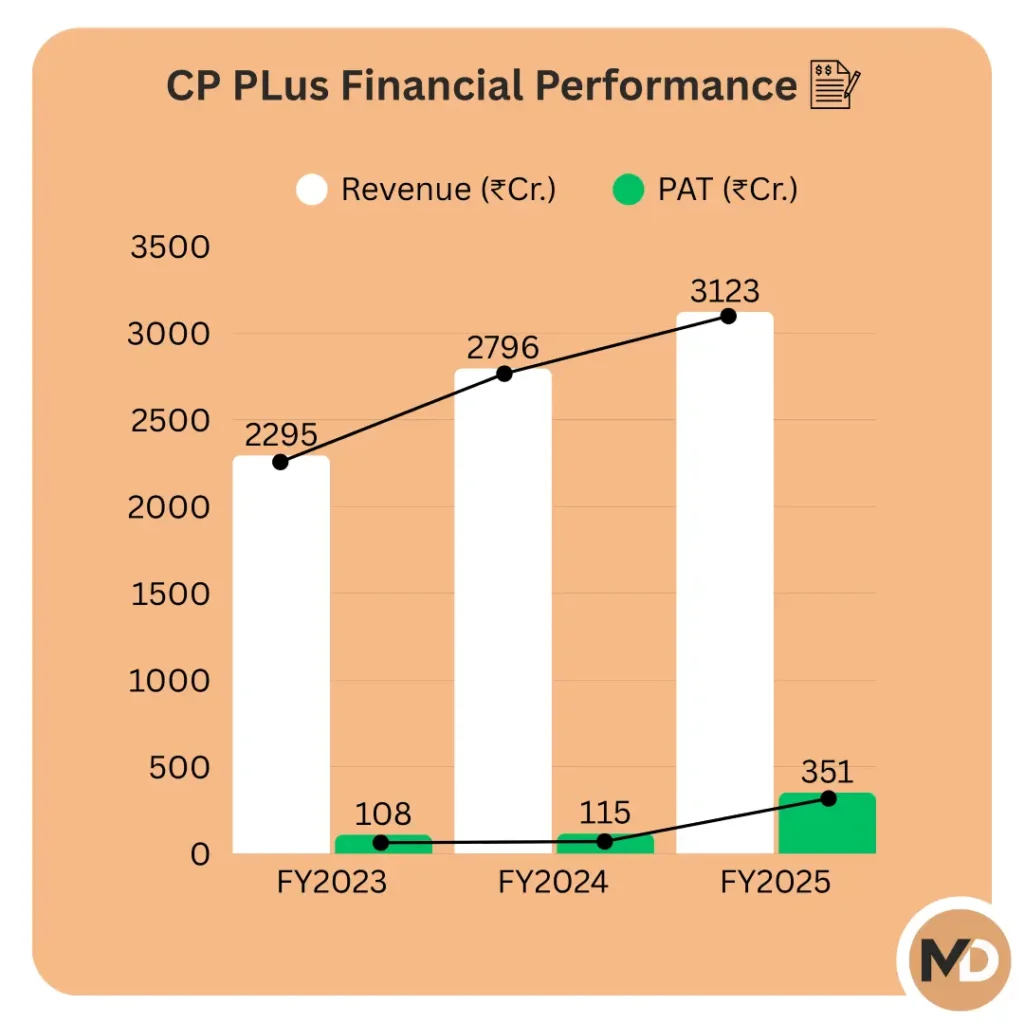

4.1. A Quick Financial Snapshot

First, let’s see how the company’s revenue and profits have grown over the last three years.

| Financial Year | Revenue (in ₹ Cr.) | Profit After Tax (in ₹ Cr.) |

|---|---|---|

| FY2023 | 2,295 | 108 |

| FY2024 | 2,796 ⬆️ | 115 ⬆️ |

| FY2025 | 3,123 ⬆️ | 351* ⬆️ |

You can see a steady growth in revenue, which is a positive sign.

However, that huge jump in profit in FY2025 needs a closer look.

*As we noted in the risks section, the FY2025 profit is inflated by a one-time, non-cash gain of approximately ₹249 crore. This is not profit from their regular business operations.

4.2. Valuation: Is the Price Fair?

This brings us to the most important question: is the IPO expensive?

To figure this out, we use a simple metric called the P/E (Price-to-Earnings) ratio.

It tells us how much we are paying for every rupee of the company’s profit.

Here’s the breakdown for Aditya Infotech:

- The Headline P/E: At the upper price of ₹675, and using the headline profit of ₹351 crore, the P/E ratio is about 22.5 times. This looks quite reasonable on the surface. (https://economictimes.indiatimes.com/markets/stocks/live-blog/ipo-gmp-nsdl-ipo-shanti-gold-ipo-aditya-infotech-ltd-price-band-grey-market-premium-today-expert-review-aditya-infotech-ipo-share-listing-date/liveblog/122967763.cms)

- The P/E on Actual Profits: However, if we rightly remove that one-time exceptional gain of ₹249 crore, the company’s actual operating profit is closer to ₹102 crore. Based on this number, the P/E ratio skyrockets to a much higher ~77 times.

What this means for you: This is precisely what analysts mean when they call the IPO “aggressively priced.” You are not paying 22.5 times its real earnings; you are paying closer to 77 times. While the company is a market leader with strong growth, investors are being asked to pay a premium price today for its expected future performance.

5. The Big Question: Should You Apply?

This is the part where we synthesize all the information. Before we do, a crucial disclaimer:

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Investing in IPOs carries significant risk. Please conduct your own research or consult with a qualified financial advisor before making any investment decisions.

The decision to apply depends entirely on your personal investment goals. Let’s look at it from two different angles:

5.1. For Short-Term Listing Gains: APPLY ✅

There is undeniable momentum behind this IPO.

- The Bull Case: The Grey Market Premium (GMP) is very strong, suggesting a high potential for a positive listing. The massive oversubscription numbers (with the retail portion subscribed over 25 times by Day 2) confirm that demand is extremely high.

- The Reality Check: Your biggest challenge is allotment. With only a 10% quota for retail investors and such high demand, the chance of getting shares is extremely low. It is essentially a lottery.

Verdict: It’s a high-demand bet for listing day gains, but winning the allotment lottery is the hard part.

5.2. For Long-Term Investment: APPLY With Caution ⚠️

Here, you need to weigh the great company against its expensive price.

- The Bull Case: You are investing in a clear market leader with a powerful brand (‘CP Plus’) and a strong ‘Make in India’ manufacturing story. The security industry itself is poised for long-term growth.

- The Reality Check: The valuation is a major hurdle. As we calculated, you are paying a premium P/E ratio of around 77 times its core earnings. This means a significant amount of its future growth is already “priced in” at the IPO level, which could limit upside for a few years until its earnings catch up to the price.

Verdict: It’s a fundamentally strong company, but you are buying it at a very expensive price. This could mean a longer wait to see substantial returns.

5.3. The Bottom Line

Most market analysts have a “Subscribe” rating on the Aditya Infotech IPO, but almost all of them highlight the aggressive valuation as a major concern.

The key takeaway is this: there’s a clear trade-off between the company’s strong fundamentals and the high price of its shares. Your decision should hinge on whether you are comfortable with that trade-off.

6. Aditya Infotech vs. NSDL: A Quick Comparison

This week, retail investors are faced with two major choices: Aditya Infotech and NSDL. Both are large, well-known companies, but they are fundamentally different. If you only have funds to apply for one, here’s a quick comparison to help you decide.

| Factor | Aditya Infotech (CP Plus) | NSDL (National Securities Depository) |

|---|---|---|

| Business Model | Designs & manufactures security/surveillance products. | Financial market infrastructure; holds securities (stocks, bonds) in electronic form. |

| Industry Type | Technology / Manufacturing | Financial Services |

| Key Strength | #1 brand in a high-growth consumer & enterprise market. | A duopoly (with CDSL) in a critical, stable industry. |

| IPO Type | Mix of Fresh Issue (₹500 Cr) & Offer for Sale (₹800 Cr). | Entirely an Offer for Sale (OFS). The company itself receives no funds. |

| Valuation (P/E) | ~77x (on core earnings) | ~47x |

| Best for… | Investors seeking high growth who are comfortable with higher risk and valuation. | Investors seeking stability and a long-term play on the growth of Indian capital markets. |

6.1. The Bottom Line

Your choice here depends entirely on your investment philosophy.

Choose Aditya Infotech if you are looking for a high-growth story tied to manufacturing and consumer trends.

Choose NSDL if you prefer a more stable, lower-risk business that forms the backbone of the entire stock market.

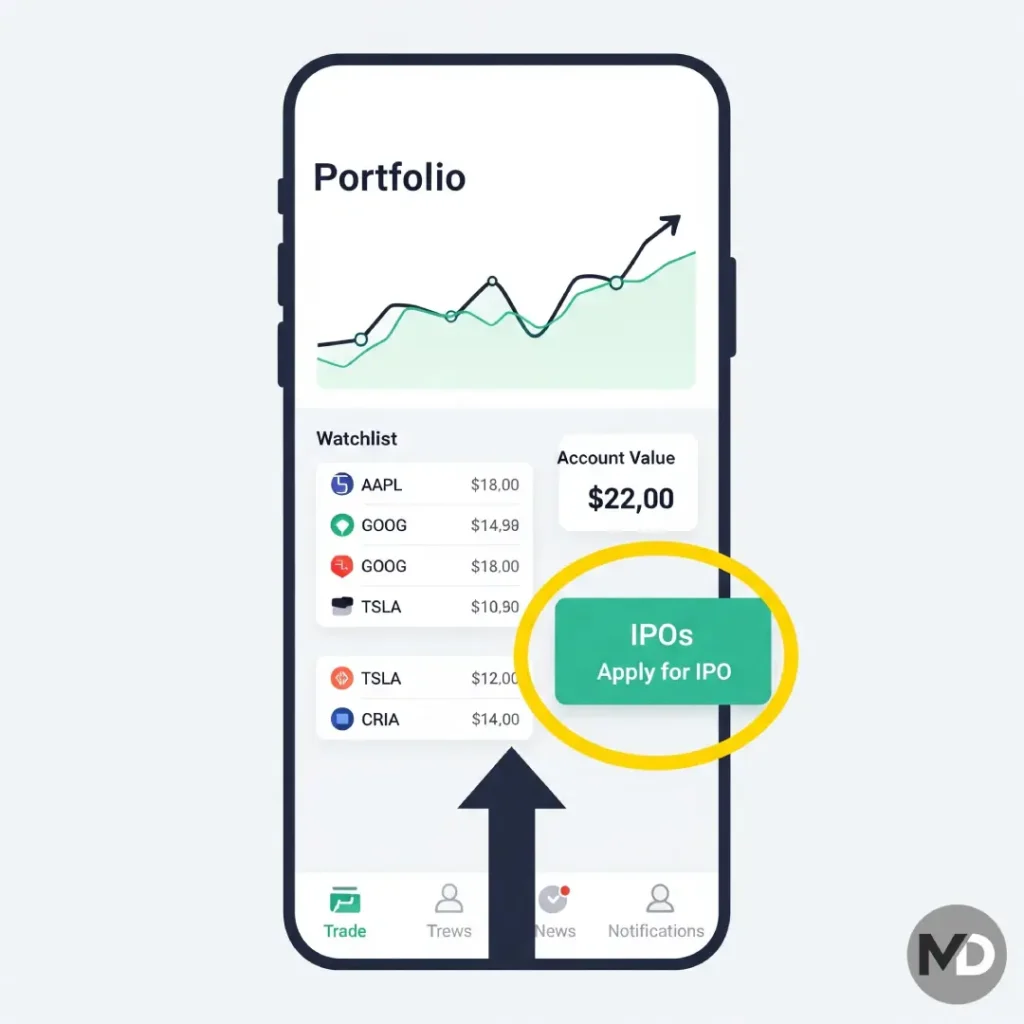

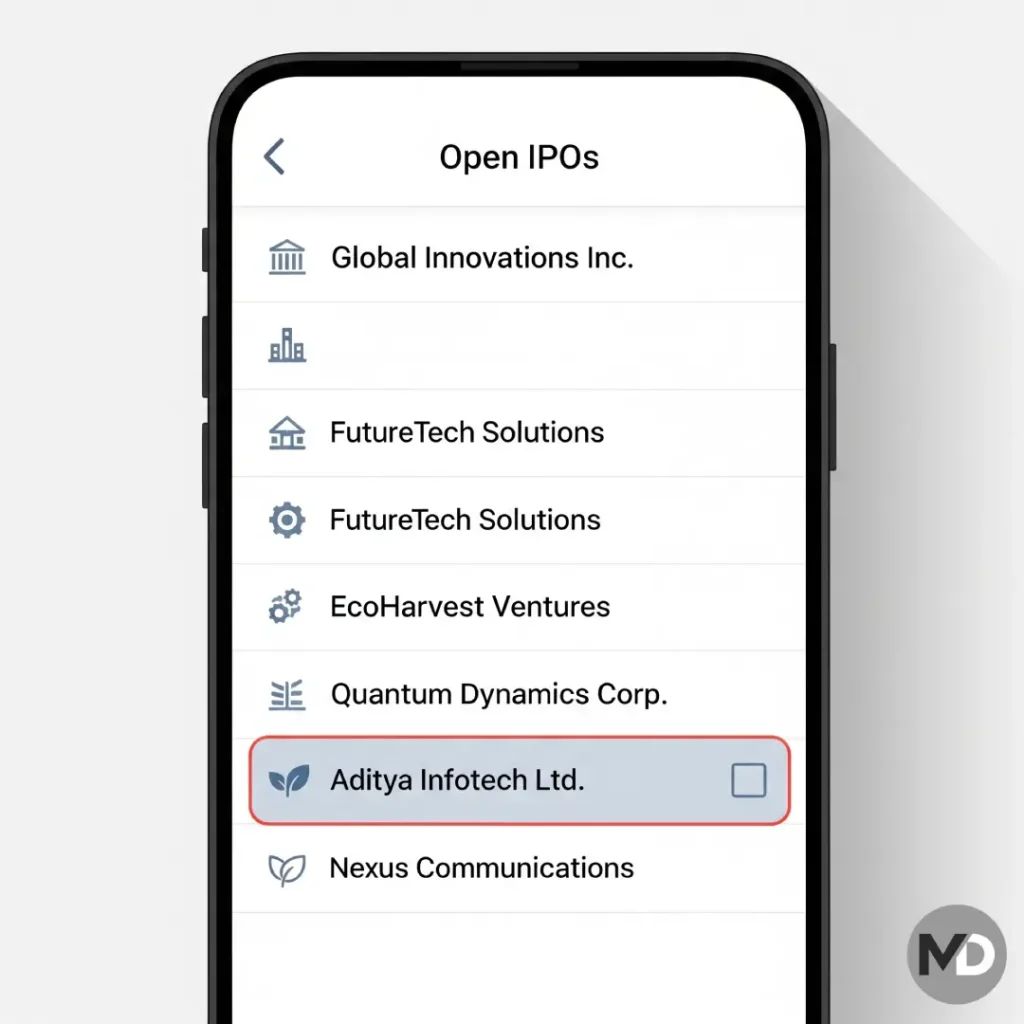

7. How to Apply for the Aditya Infotech IPO (with Visuals)

If you’ve weighed the pros and cons and decided to apply, here’s a simple visual guide to the process. Remember, the IPO window closes tomorrow, July 31st, 2025.

7.1. Make Sure You’re Ready

Before you start, you need two things:

- A Demat & Trading Account with any major broker (like Zerodha, Groww, Upstox, HDFC Securities, etc.).

- A UPI ID (from an app like GPay, PhonePe, Paytm) that is linked to the bank account connected to your Demat account.

7.2. Fill Out the Application

7.2.1. Log in to your brokerage app

7.2.2. Find the IPO section

7.2.3. Select “Aditya Infotech Ltd” from the list of open IPOs

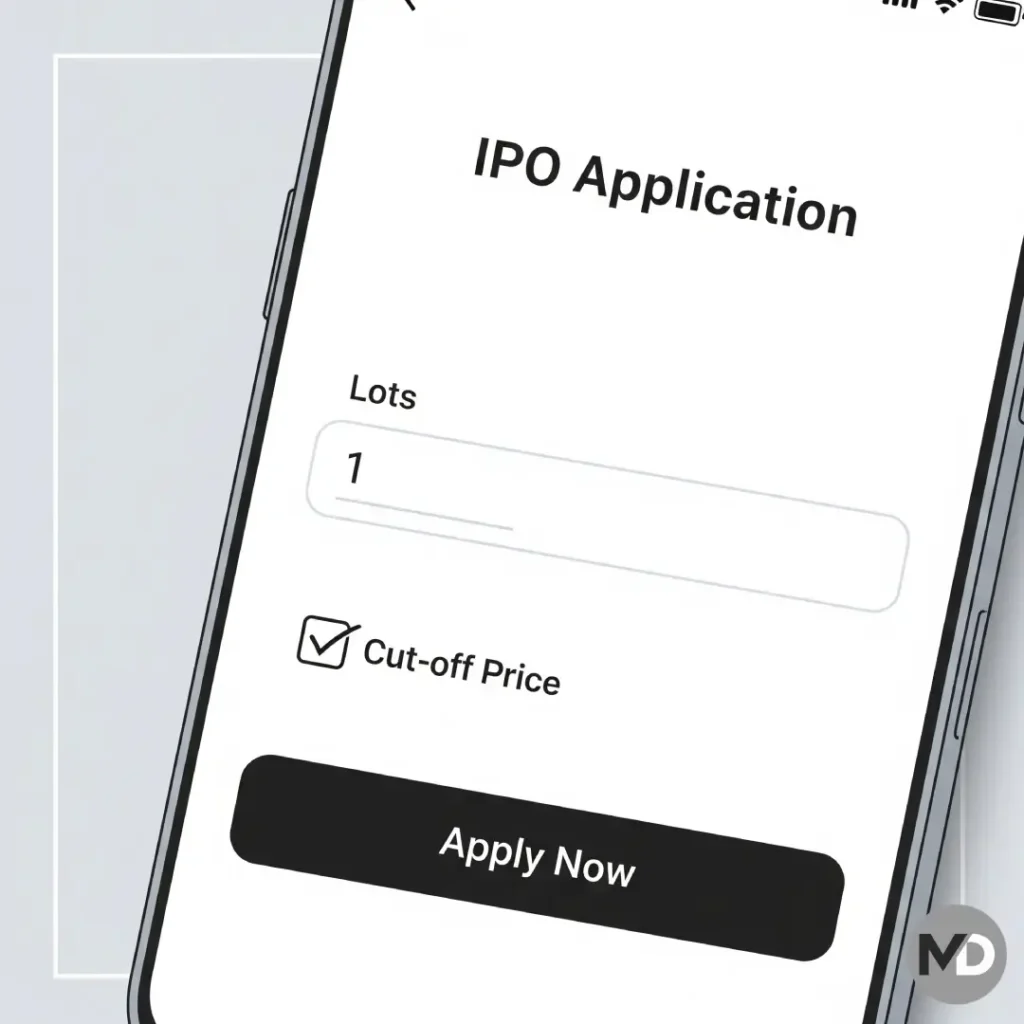

7.2.4. Enter Your Bid. This is the important part

- Quantity: You apply in “lots”. Enter 1 lot (which is 22 shares) or multiples of it.

- Price: To maximize your chances of getting an allotment, select the “Cut-off Price” option. This means you agree to apply at the final price decided by the company (which will be ₹675 for retail investors if the issue is oversubscribed).

- Confirm your UPI ID and submit the application.

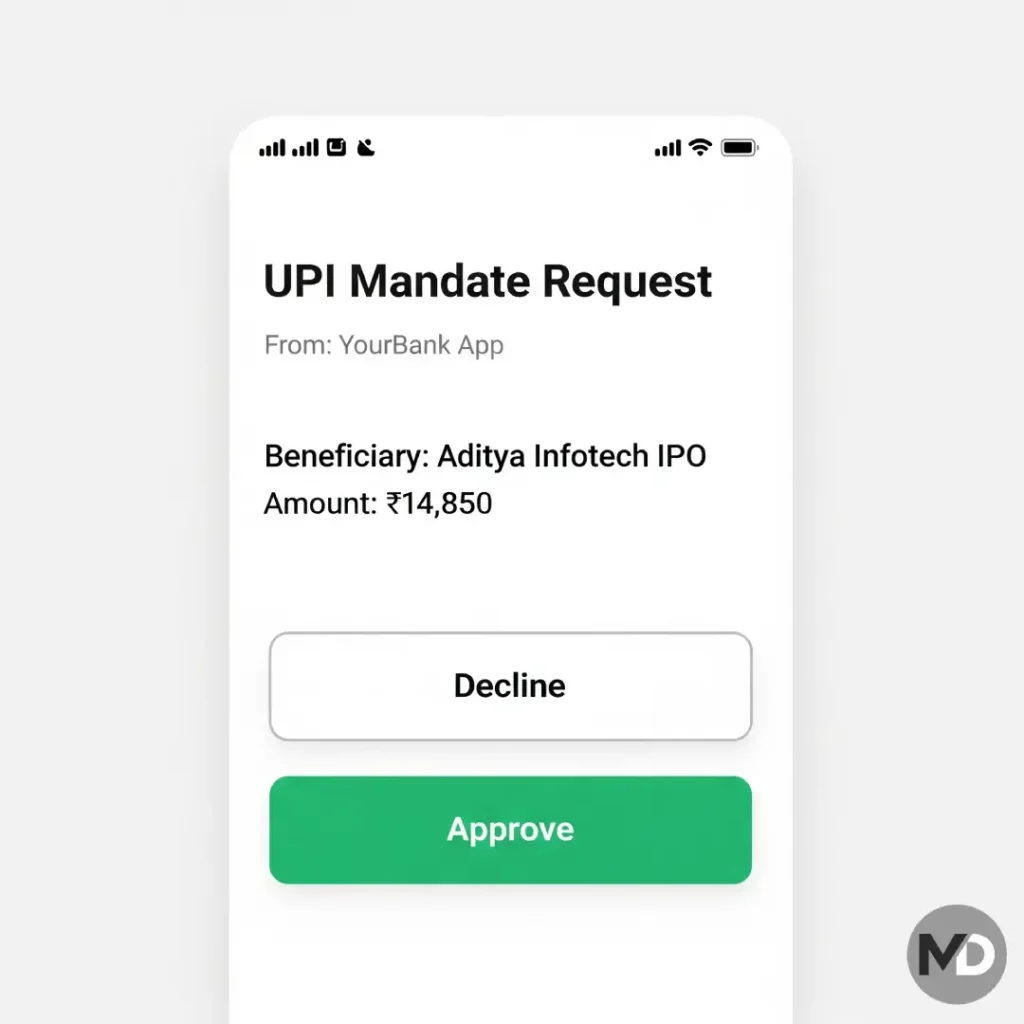

7.3. Approve the UPI Mandate

Within a few hours of submitting, you will receive a payment request on your UPI app.

- Open your UPI app (GPay, PhonePe, etc.) and you will see a pending “mandate request”.

- Approve the payment. The amount (₹14,850 for one lot) will be blocked in your account, not debited. It will only be debited if you are allotted shares.

Your application is only complete after you approve this mandate!

Step 4: Important Dates to Track

After you’ve applied, the process moves quickly.

Here are the key dates to mark on your calendar. Note that these dates are tentative and can change.

| Event | Date (Tentative) | What It Means for You |

| IPO Allotment Finalization | Friday, August 1, 2025 | The day you find out if you received shares or not. |

| Refund Initiation | Monday, August 4, 2025 | If no shares were allotted, your blocked money is released. |

| Shares Credit to Demat | Monday, August 4, 2025 | If allotted, the shares appear in your Demat account. |

| IPO Listing Date | Tuesday, August 5, 2025 | The day Aditya Infotech starts trading on the stock exchange. |

Conclusion: Final Thoughts

We’ve covered a lot of ground, from the power of the CP Plus brand to the complexities of its valuation. Let’s boil it down to the three most important takeaways for the Aditya Infotech IPO:

- A-Grade Business: There’s no doubt that Aditya Infotech is a market-leading company with a powerful brand, strong manufacturing capabilities, and a solid position in a growing industry.

- Premium Price Tag: The biggest point of concern is the aggressive valuation. At a price-to-earnings (P/E) ratio of around 77x its core profits, you are paying a significant premium for the company’s future growth.

- High Demand, Low Chance: The IPO is seeing massive demand, which is a good sign for potential listing gains. However, with only a 10% retail quota, the probability of getting an allotment is extremely low.

Ultimately, the decision to apply is a personal trade-off between buying into a great business and paying a high price for it.

We want to hear from you!

What are your thoughts on the Aditya Infotech IPO? Are you applying? Share your perspective in the comments section below!

(Disclaimer: All information in this article is for educational purposes only and should not be considered as financial advice. Please do your own research before investing.)

- 10+ Best SEBI-Registered Telegram Channels 2026 - February 25, 2026

- Top 5 SEBI-Registered Telegram Channels For Option Trading [2026] - February 12, 2026

- 10 Best Nifty 50 Options Trading Telegram Channels [2026] - February 12, 2026

Discover more from Mobodaily

Subscribe to get the latest posts sent to your email.