With another public offer hitting the market, is the Crizac Limited IPO the right investment for you?

This Kolkata-based B2B education platform, a key player in recruiting Indian students for UK universities, is launching its ₹860 crore IPO today.

As it’s 100% Offer for Sale (OFS), the company won’t receive any proceeds, raising important questions for investors about future growth and value.

This review will dissect Crizac’s financials, growth prospects, and valuation to provide a clear perspective. Let’s explore whether this opportunity aligns with your investment goals.

I. Crizac Limited IPO: The Nitty-Gritty Details

The public offer was open for subscription from July 2, 2025 to July 4, 2025.

According to the official offer documents available on the National Stock Exchange (NSE), the company has set the price band at ₹233 to ₹245 per share. For retail investors, the minimum lot size is 61 shares, which translates to an investment of ₹14,945 at the upper price point.

The total IPO size is approximately ₹860 crores. It is crucial for investors to note that this is entirely an Offer for Sale (OFS).

This means the company will not receive any proceeds from the public issue; the funds will go directly to the selling promoters. The primary objectives, as stated in the prospectus, are to allow the promoters to liquidate some of their holdings and to achieve the benefits of listing the shares on the BSE and NSE. A listing enhances brand visibility and creates a public market for the stock.

The tentative listing date, when the shares will begin trading, is set for Wednesday, July 9, 2025.

Recommended: Travel Food Services IPO is live: Check GMP, Financial, and Review!

II. Crizac IPO Grey Market Premium (GMP)

Here is a snapshot of the GMP for the Crizac IPO in the days leading up to and on the first day of the subscription period:

| GMP Date | IPO Price (₹) | GMP | Estimated Listing Price | Estimated Profit* |

|---|---|---|---|---|

| 07-07-2025 (allotment) | 245 | ₹39 ↓ | ₹284 (15.92%) | ₹2379 |

| 06-07-2025 | 245 | ₹43 ↔️ | ₹288 (17.55%) | ₹2623 |

| 05-07-2025 | 245 | ₹43 ↑ | ₹288 (17.55%) | ₹2623 |

| 04-07-2025 (close) | 245 | ₹35 ↑ | ₹280 (14.29%) | ₹2135 |

| 03-07-2025 | 245 | 27.5 ↓ | ₹272.5 (11.22%) | ₹1677.5 |

| 02-07-2025 (Open) | 245 | ₹39 ↑ | ₹284 (15.92%) | ₹2379 |

| 01-07-2025 | 245 | ₹21 ↑ | ₹266 (8.57%) | ₹1281 |

| 30-06-2025 | 245 | ₹0 | ₹245 (0.00%) | ₹0 |

GMP Analysis:

- Positive Momentum: The data shows strong positive momentum for the IPO in the grey market. The GMP started at ₹0 on June 30th and has risen significantly to ₹43 by the opening day of the IPO.

- Increased Listing Premium: This upward trend suggests growing investor confidence and points to a potential listing day premium of around 13% over the issue price, which is a healthy sign.

- Strong Demand: The increase from ₹21 on July 1st to ₹43 on July 5th indicates a sharp rise in demand and willingness to pay a premium for the shares before listing.

III. Crizac IPO Allotment Status

With the bidding for the Crizac IPO now closed, investors are eagerly awaiting the allotment of shares. Given the strong oversubscription, not everyone who applied will receive an allotment.

Key Allotment & Listing Dates:

- Allotment Finalization Date: Monday, July 7, 2025

- Refund Initiation: Tuesday, July 8, 2025

- Shares Credited to Demat: Tuesday, July 8, 2025

- Tentative Listing Date: Wednesday, July 9, 2025

How to Check Your Allotment Status

Once the allotment is finalized on July 7th, you can check your status in a few simple steps. The official registrar for the Crizac IPO is MUFG Intime India Private Limited.

Method 1: Check on the Registrar’s Website (MUFG Intime)

- Go to the official MUFG Intime IPO Allotment page: https://in.mpms.mufg.com/Initial_Offer/public-issues.html

- Select “Crizac Limited” from the dropdown menu of company names.

- Enter your PAN Card number, Application Number, or your DP/Client ID.

- Click ‘Search’ to view your allotment status. It will show you if you were allotted shares and how many.

Method 2: Check on the BSE Website

- Go to the BSE’s official allotment status page: https://www.bseindia.com/investors/appli_check.aspx

- Under ‘Issue Type’, select ‘Equity’.

- From the ‘Issue Name’ dropdown, choose “Crizac Limited”.

- Enter your Application Number and PAN Card number.

- Complete the ‘I’m not a robot’ verification and click ‘Search’.

Your allotment details will be displayed on the screen. Good luck to all who have applied!

IV. Crizac Subscription Status

How Did Investors Respond?

Here’s the breakdown of how different investor categories responded to the Crizac Limited IPO as of 5:00 PM IST on Day 1 (July 2, 2025).

| Category | NO OF SHARES OFFERED | NO OF SHARES BID FOR | NO OF TIMES OF TOTAL MEANT FOR THE CATEGORY |

|---|---|---|---|

| Qualified Institutional Buyers(QIBs) | 70,20,407 | 99,17,49,956 | 141.27x |

| Non Institutional Investors (NIIs) | 52,65,306 | 42,15,96,010 | 80.07x |

| Retail Individual Investors(RIIs) | 1,22,85,714 | 13,19,57,274 | 10.74x |

| Total | 2,58,36,909 | 30,98,00,639 | 62.89x |

(Source: NSE India)

Analysis:

The subscription data reveals a few key trends:

- Muted Institutional Response: The Qualified Institutional Buyers (QIB) category, often considered the “smart money,” shows a very weak response with only 0.09 times subscription. This indicates a significant lack of interest from large financial institutions at the current valuation.

- Moderate HNI and Retail Interest: The Non-Institutional Investors (NII) and Retail (RII) categories have been subscribed 0.62 and 0.59 times, respectively. While there is some participation, neither category is fully subscribed, which is uncommon for a high-growth company.

- Overall Picture: With a total subscription of only 0.46 times, the overall demand for the IPO is exceptionally lukewarm. This suggests that the market, as a whole, perceives the issue to be overvalued or too risky, especially given that it is a 100% Offer for Sale. The low subscription numbers align with a volatile and modest Grey Market Premium, signaling a high probability of a weak stock market debut.

V. About Crizac Limited

To decide on an IPO, you first need to understand the company behind it.

So, what exactly does Crizac Limited do?

Founded in 2011 in Kolkata, Crizac Limited operates as a B2B (Business-to-Business) education platform.

According to its Draft Red Herring Prospectus (DRHP), its primary business is offering international student recruitment solutions.

Instead of directly enrolling students, it has built a technology-driven bridge connecting a massive network of student recruitment agents with international universities.

You can find more details on their official “About Us” page on crizac.com.

Here’s how its asset-light model works:

- For Recruitment Agents: Crizac provides a proprietary online platform that gives smaller agents access to over 170 universities and 80,000 courses across the UK, Canada, Australia, and other countries. This allows them to offer a wider range of options to their students without needing direct contracts with each university.

- For Universities: Crizac acts as a master recruiter, providing a vetted stream of applications from its vast network of over 3,900 active agents. This simplifies the university’s recruitment process, giving them broad access to the Indian student market.

The company’s revenue is primarily earned through commissions from universities for each student who successfully enrolls through its platform.

Industry Landscape:

Crizac operates within the burgeoning study-abroad market in India, which has seen explosive growth. The UK, Crizac’s stronghold, has been a particularly popular destination.

This trend was significantly boosted by favorable post-study work policies like the Graduate Route Visa, which has led to a surge in Indian students choosing the UK, as reported by outlets like the Times of India.

While the market is large, it is also highly competitive and sensitive to policy changes in destination countries—a key factor for investors to consider.

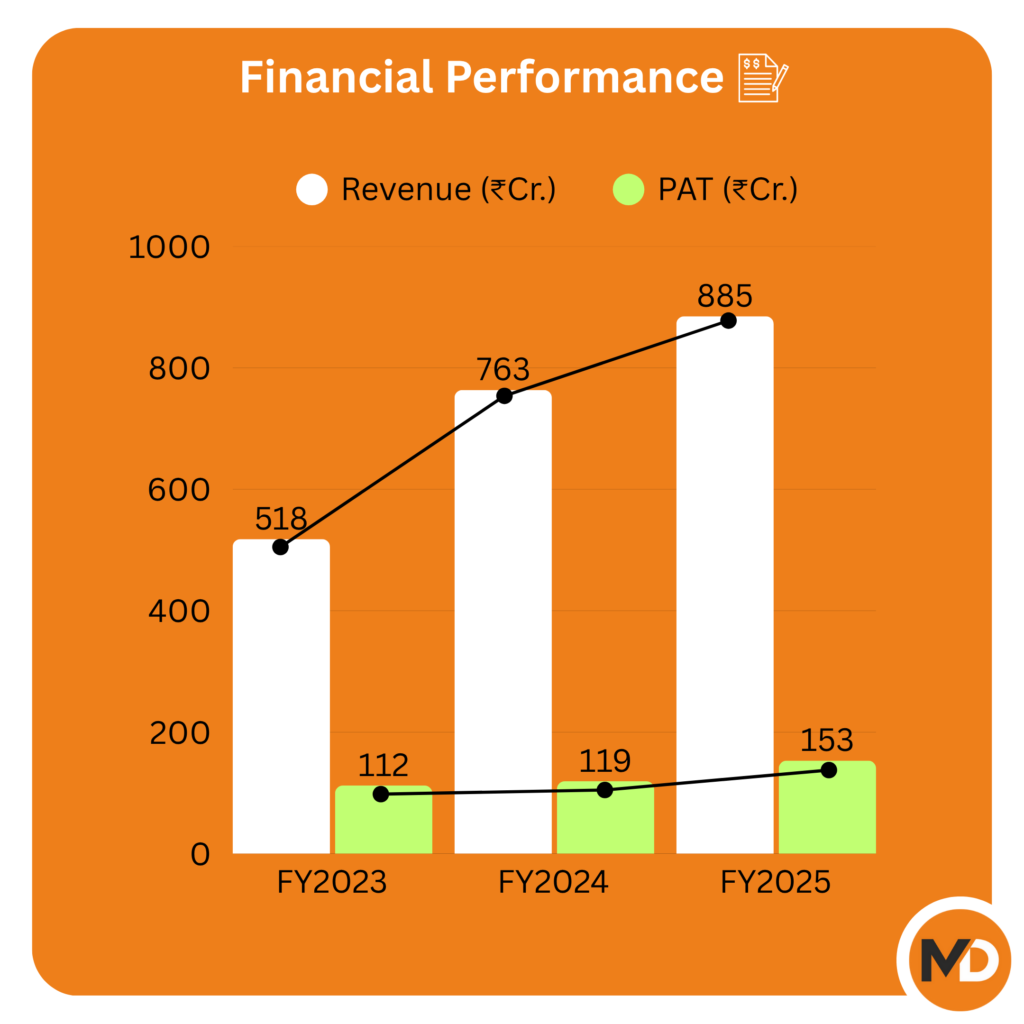

VI. Crizac Financial Performance

A company’s story is best told through its numbers.

For Crizac, the financial data reveals a compelling picture of rapid growth and strong profitability.

We’ve dug into their official offer documents to pull the key metrics for you.

Here’s a snapshot of their performance over the last three fiscal years:

| Financial Metric | FY2023 | FY2024 | FY2025 |

|---|---|---|---|

| Revenue from Operations (₹ Cr) | 517.85 | ₹763.44 ↑ | ₹884.78 ↑ |

| Profit After Tax (PAT) (₹ Cr) | 112.14 | ₹118.90 ↑ | ₹152.93 ↑ |

| EBITDA (₹ Cr) | 107.29 | 72.64 | 212.82 |

| PAT Margin (%) | 21.65% | 15.57% | 17.28% |

| Return on Equity (RoE %) | 50.66% | 34.79% ↓ | 30.24% ↓ |

(Source: Financial figures are compiled from the company’s Red Herring Prospectus (RHP) and other financial reports. Note that FY2023 figures are standalone, while FY2024 and FY2025 are consolidated.)

Key Takeaways from the Financials:

- Impressive Revenue Growth: The top line shows strong and consistent growth, with revenue surging from ~₹518 crores to ~₹885 crores in just two years. This indicates high demand for its services.

- Consistent Profitability: The company is not just growing; it’s doing so profitably. The Profit After Tax (PAT) has steadily increased, reaching over ₹152 crores in the latest fiscal year.

- Strong Margin Recovery: While there was a noticeable dip in margins in FY24, the company showed a powerful rebound in FY25 with an EBITDA margin of over 25%. This suggests effective cost control as it scales.

- Healthy Return Ratios: A Return on Net Worth (RoNW) of over 30% in FY25 is excellent. While the percentage has decreased from FY23, this is mainly due to an expanding equity base, not a decline in performance.

- Virtually Debt-Free: The company has negligible debt on its books. This financial discipline is a significant advantage, reducing risk and giving it flexibility for future plans.

For a deeper dive into the numbers, you can refer to the detailed financial statements in the company’s official RHP filing.

VII. The Full Picture: Strengths vs. Weaknesses

| Strengths (The Bull Case) | Weaknesses & Risks (The Bear Case) |

|---|---|

| Asset-light, highly scalable business model. | Heavy revenue dependence on the UK market. |

| Strong financials with high growth and no debt. | IPO is 100% Offer for Sale (OFS); no funds to the company. |

| Powerful network effect with 10,000+ agents. | High revenue concentration from a few universities. |

| Experienced promoters with deep industry ties. | Valuation at ~28x P/E is considered fully priced. |

| Positioned in a long-term growth industry. | Intense competition from other recruitment platforms. |

Download strengths and weaknesses ⬇️

VIII. Peer Comparison: How Does Crizac Stack Up?

Valuing Crizac is tricky because there are no directly comparable publicly listed companies in India that operate on the exact same B2B student recruitment model. This makes a true “apples-to-apples” comparison challenging.

However, to get a sense of the valuation, we can look at a B2B platform in a different sector and other companies in the broader education space.

| Company | Business | P/E Ratio |

|---|---|---|

| Crizac Limited | B2B Student Recruitment | ~28x |

| Indiamart Intermesh | B2B E-commerce Platform | ~29x |

| CL Educate | Diversified Education & Training | ~20x |

| IDP Education (Australia) | Global Student Placement | ~35x |

(Source: Times Of India)

Analysis:

- Against B2B Platforms: Crizac’s valuation at a Price-to-Earnings (P/E) ratio of ~28 times is very similar to Indiamart Intermesh, another major B2B platform. This suggests the market is valuing it as a technology platform rather than a traditional education company.

- Against a Global Peer: When compared to IDP Education, a global leader in student placement listed in Australia, Crizac’s valuation appears more reasonable.

- Against Domestic Education Companies: It is demanding a higher premium than other domestic players like CL Educate, which have different business models and lower growth profiles.

IX. The Final Verdict: Should You Apply?

After weighing the strong fundamentals against the significant risks and analyzing the live market data, we arrive at the crucial question: should you invest in the Crizac Limited IPO?

The company is undeniably a high-growth, profitable, and debt-free leader in its niche.

However, this is countered by a fully priced valuation, a 100% Offer for Sale structure, heavy dependence on the UK market, and a lukewarm response from institutional investors on Day 1.

Here is our final verdict based on these factors:

High-risk investors can APPLY.

This recommendation is based on the live Grey Market Premium (GMP), which, despite being volatile, is still positive and indicates a potential listing day premium of around 13%.

For an investor with a high-risk tolerance, this presents an opportunity for modest, short-term gains. The strong retail interest could also support the price upon listing. However, the risk is high, and this is purely a tactical play.

Long-term investors should AVOID.

This IPO is not ideal for long-term wealth creation at the current price. The entire ₹860 crores from the IPO are going to the promoters, not into the company for future growth.

An investor is buying into a company at a full valuation without providing it any growth capital. Given the significant geopolitical risks tied to the UK and intense competition, the current entry point appears unfavorable for those with a multi-year investment horizon.

It may be more prudent to wait and watch the company’s performance post-listing.

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Investing in IPOs carries significant risk. Please consult with a qualified financial advisor before making any investment decisions. The author is not responsible for any financial losses.

- 4 Best IPOs to Watch This Week (July 23-29): GNG, Brigade & More! - July 23, 2025

- Anthem Biosciences IPO: 5 Reasons to Apply Before 5 PM Today! - July 16, 2025

- Travel Food IPO GMP, Subscription, Allotment: What to do on Listing? - July 9, 2025